RESEARCH

PAPER ON GOLDEN SPICE IN GLOBAL MARKETS: TRENDS, CHALLENGES, AND OPPORTUNITIES

FOR INDIAN TURMERIC"

Abstract

Turmeric (“Haldi”), a staple spice

in Indian households, has gained significant global recognition for its

culinary, medicinal, and cosmetic benefits. India’s dominance in the turmeric

market, both in terms of production and export, is unrivaled. This paper

provides a comprehensive analysis of turmeric production, exports, market

trends, and emerging opportunities. Additionally, it delves into the latest

data from 2024-25, major turmeric-producing companies, their market shares,

GI-tagged turmeric varieties, and recommendations for enhancing India's

position in the global turmeric market.

1.

Introduction

Turmeric (Curcuma longa), a rhizome

belonging to the ginger family, is widely cultivated in tropical regions. Known

for its high curcumin content, turmeric is used in food, medicine, cosmetics,

and as a natural dye. India accounts for over 80% of the world’s turmeric

production and dominates the export market, catering to the rising global

demand.

1.

Global Turmeric Production

Table

1: Top 10 Haldi Producing Countries (2024-25)

|

Rank |

Country |

Estimated

Production (Million Tons) |

|

1 |

India |

8.2 |

|

2 |

China |

0.52 |

|

3 |

Thailand |

0.43 |

|

4 |

Myanmar |

0.38 |

|

5 |

Peru |

0.32 |

|

6 |

Vietnam |

0.27 |

|

7 |

Indonesia |

0.21 |

|

8 |

Bangladesh |

0.16 |

|

9 |

Nepal |

0.11 |

|

10 |

Sri Lanka |

0.09 |

India’s dominance stems from optimal

climatic conditions, fertile soil, and centuries-old cultivation practices.

States such as Andhra Pradesh, Telangana, Tamil Nadu, Karnataka, and Odisha are

the primary producers.

Export

Trends and Statistical Analysis (2014–2024)

Export

Volume and Value Trends

Indian turmeric exports have shown

consistent growth in both volume and value over the last decade due to

increasing global demand for natural and organic products.

Table

2 : Indian Turmeric Export Trends (2014–2024)

|

Year |

Export

Volume (Metric Tons) |

Export

Value (USD Million) |

|

2014 |

72,000 |

123 |

|

2015 |

84,500 |

150 |

|

2016 |

98,000 |

176 |

|

2017 |

105,000 |

200 |

|

2018 |

122,000 |

240 |

|

2019 |

135,000 |

280 |

|

2020 |

145,000 |

320 |

|

2021 |

158,000 |

350 |

|

2022 |

170,000 |

390 |

|

2023 |

190,000 |

430 |

|

2024 |

210,000 |

475 |

Here is the line graph visualizing the

year-on-year trends in Indian turmeric exports (2014–2024), showcasing both

export volume (in metric tons) and export value (in USD million)

Top

Exporting Companies

Table 3 :The contribution of major companies

has been pivotal in India’s export growth.

|

Company

Name |

Export

Share (Avg.) |

Key

Destinations |

|

A.G. Agro Exports |

12% |

USA, UAE |

|

ITC Limited |

8% |

EU, Japan |

|

Patanjali Ayurved |

10% |

UAE, UK |

|

Everest Spices |

6% |

Middle East |

|

Organic India Pvt. Ltd. |

7% |

USA, Canada |

Export

Value by Region (2024)

- North America:

35%

- Europe:

25%

- Asia-Pacific:

20%

- Middle East and Africa: 15%

- Others:

5%

Statistical

Insights

- Compound annual growth rate (CAGR) for turmeric export

value: 12.5% (2014–2024).

- CAGR for export volume: 10% (2014–2024).

.

Indian Turmeric Export Data (2024-25)

Table

4: Indian Turmeric Export Overview

|

Metric |

Value |

|

Total Turmeric Export Shipments |

265,000 |

|

Number of Indian Exporters |

8,100 |

|

Number of International Buyers |

28,000 |

|

Total Export Volume (Metric Tons) |

1.5 lakh |

|

Total Export Value (USD) |

475 million |

The United States, the United

Kingdom, the UAE, and Malaysia are the primary destinations for Indian turmeric

exports. The global preference for Indian turmeric is due to its superior

quality and high curcumin content.

4.

Major Turmeric Companies in India and Market Share

Table

5: Leading Indian Turmeric Exporters (2024-25)

|

Company Name |

Market Share (%) |

Key Products |

|

A.G. Agro Exports |

12% |

Whole turmeric, turmeric powder |

|

Patanjali Ayurved |

10% |

Organic turmeric |

|

ITC Limited |

8% |

Processed turmeric products |

|

Neelam Food Products Ltd |

7% |

Turmeric powder |

|

Sri Sri Tattva |

6% |

Ayurvedic turmeric products |

|

Godrej International |

5% |

Turmeric extracts |

These companies contribute

significantly to India’s dominance in the global turmeric market by offering

high-quality, competitively priced products.

5.

GI-Tagged Turmeric Varieties in India

India is home to several GI-tagged

turmeric varieties that highlight regional specialties:

- Sangli Turmeric

(Maharashtra): Renowned for its deep orange hue and high curcumin content.

- Erode Turmeric

(Tamil Nadu): Known for its bright yellow color and medicinal properties.

- Nizamabad Turmeric

(Telangana): Popular for its aromatic flavor.

- Alleppey Turmeric

(Kerala): High curcumin content, ideal for export.

6.

Trends in Global Turmeric Demand

The rising awareness of turmeric’s

medicinal properties, particularly its anti-inflammatory and antioxidant

benefits, is driving global demand. Organic turmeric and value-added products

like turmeric latte mixes, capsules, and essential oils are gaining traction in

international markets.

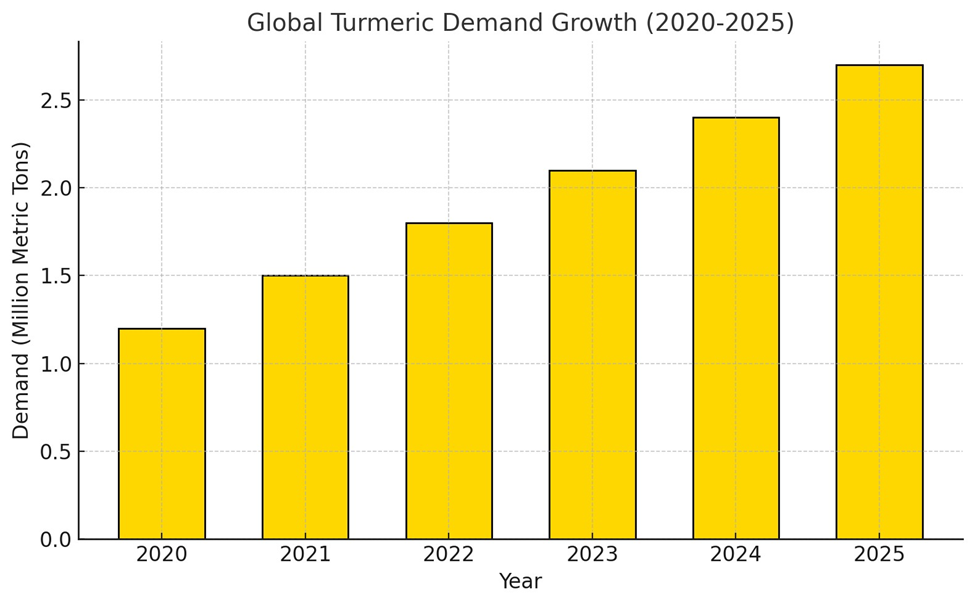

Here is the bar graph showing the steady growth of global

turmeric demand from 2020 to 2025.

7.

Challenges in Turmeric Production and Export

- Price Fluctuations:

Dependence on monsoons affects production and pricing.

- Quality Control:

Ensuring uniform curcumin levels is critical for maintaining export

standards.

- Global Competition:

Emerging players like Myanmar and Peru are intensifying competition.

- Organic Certification:

Meeting stringent organic standards for export markets.

8 Government Strategies to Boost Turmeric Products

1. Export

Promotion Policies: Provide subsidies and incentives to exporters,

particularly for value-added turmeric products.

2. Infrastructure

Development: Establish turmeric processing units, cold storage

facilities, and logistics hubs in major producing states.

3. Research

and Innovation Funding: Allocate resources for R&D in

turmeric-based nutraceuticals, cosmetics, and pharmaceuticals.

4. Marketing

Support: Organize international trade fairs and marketing campaigns

highlighting India’s GI-tagged turmeric varieties.

5. Farmer

Support Programs: Introduce training programs for farmers to adopt

organic and sustainable farming practices, ensuring higher yields and better

market access.

6. Digital

Platforms: Launch e-marketplaces for turmeric to connect farmers with

global buyers, ensuring transparency and better price realization.

7. Collaboration

with Ayurveda and Pharma: Promote partnerships between turmeric

farmers, Ayurveda manufacturers, and pharmaceutical companies to boost domestic

and export demand.

8. Brand

India Initiative: Create a global brand identity for Indian turmeric,

emphasizing its superior quality, medicinal benefits, and heritage.

9. Opportunities and Recommendations

1. Focus

on Value-Added Products: Indian exporters should diversify their

product portfolio to include turmeric-based nutraceuticals, cosmetics, and

functional foods.

2. Enhanced

Branding and Marketing: Highlight the uniqueness of GI-tagged

varieties to attract premium buyers.

3. Digital

Integration: Use technology to improve traceability and transparency

in the supply chain.

4. Collaborations:

Encourage partnerships between farmers and exporters for better price

realization.

5. Research

and Development: Invest in innovations to enhance productivity and

reduce post-harvest losses.

10.

Conclusion

India’s unparalleled position in the

global turmeric market provides immense opportunities for growth. By focusing

on quality, innovation, and sustainability, India can further consolidate its

dominance and achieve its export target of USD 1 billion by 2030. India’s

turmeric industry has experienced exponential growth in the last decade, driven

by increased global awareness of its health benefits. The strategic focus on

GI-tagged varieties, value-added products, and sustainable cultivation

practices can further enhance India’s dominance in this market. Achieving a

target export value of USD 1 billion by 2030 is plausible with concerted efforts

from stakeholders

11.

References

- Eximpedia.app. (2024). Haldi Export Data and Insights.

- Spice Board of India Reports (2023-24).

- Trade Data Analysis Reports (2024).

- Government of India: Ministry of Agriculture and

Farmers’ Welfare.

Comments

Post a Comment