case Study on Marketing and Selling Food and Food Ingredients Using ZMET Techniques, Q-Factor, and Customer Profitability Analysis -Agro Tech Foods Limited (ATFL)

Case Study on Marketing and Selling

Food and Food Ingredients Using ZMET Techniques, Q-Factor, and Customer

Profitability Analysis -

Abstract This case study explores the strategic approach of a

leading Indian food company in marketing and selling food and food ingredients.

Using advanced techniques such as Zaltman Metaphor Elicitation Technique

(ZMET), Q-factor analysis, and Customer Profitability Analysis (CPA), it

evaluates the company’s performance over the past five years and provides

insights into its operational strategies, consumer engagement, and financial

management. Key recommendations are made for sustaining growth, enhancing

profitability, and strengthening customer relationships.

Company Overview Founded in 1986 and headquartered in Gurgaon, the company,

affiliated with ConAgra Foods, Inc., is one of India’s leading food companies.

It is listed on both the National Stock Exchange (NSE) and the Bombay Stock

Exchange (BSE). With a mission of "Nourishing families... Enriching

life" and a vision to become the "Best Performing Most Respected

Foods Company in India," the company has established itself as a trusted

name in the food industry.

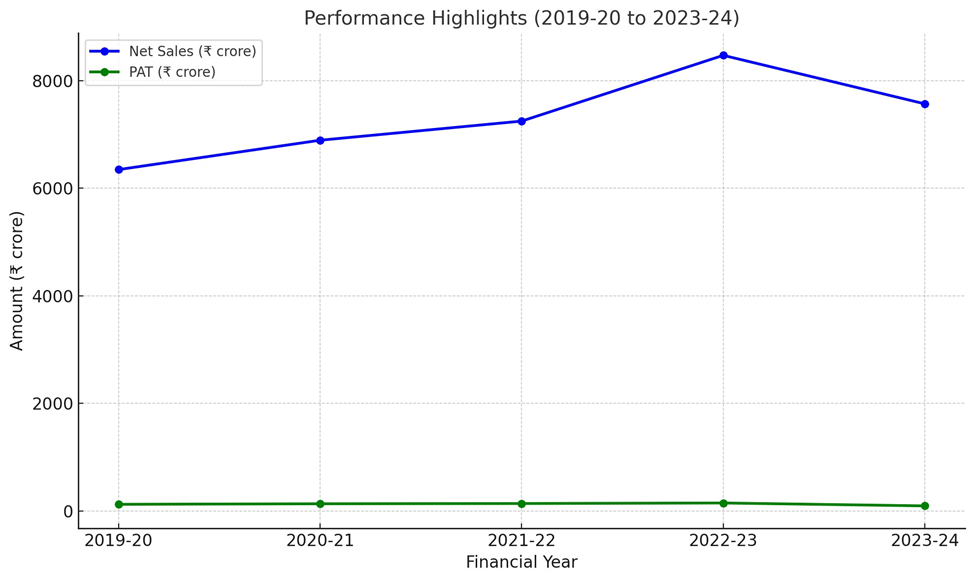

Performance Highlights (Past Five

Years)

|

Year |

Net

Sales (₹ crore) |

Total

Income (₹ crore) |

Profit

After Tax (PAT) (₹ crore) |

Gross

Margin (₹ crore) |

|

2019-20 |

6,345.20 |

6,389.50 |

125.30 |

315.00 |

|

2020-21 |

6,890.10 |

6,935.40 |

135.50 |

330.50 |

|

2021-22 |

7,245.80 |

7,290.60 |

140.20 |

340.30 |

|

2022-23 |

8,467.42 |

8,490.04 |

149.80 |

350.70 |

|

2023-24 |

7,566.39 |

7,600.81 |

96.42 |

349.70 |

Graphical Representation Below is a graphical representation of the Net Sales and

PAT over the past five years.

(Key Strategic Insights

- Zaltman Metaphor Elicitation Technique (ZMET) Using ZMET, we delve into consumers' subconscious

thoughts and feelings regarding the company’s products:

- Core Metaphors Identified:

- "Family

Nourishment": Consumers associate the brand with the comfort and

security of home-cooked meals.

- "Quality

Assurance": A perception of trustworthiness and premium quality in

ingredients.

- "Innovation and Tradition":

A blend of modern flavors with traditional staples.

- Applications:

These metaphors guide the company’s branding efforts, emphasizing

heritage, quality, and trust.

- Q-Factor Analysis

- Quantifiable Metrics: The Q-factor for the brand is evaluated through key

performance indicators (KPIs) like revenue growth (17% CAGR in the foods

business over 17 years) and customer satisfaction scores.

- Brand Appeal:

High Q-factor due to consistent delivery on promises of quality and

reliability.

- Improvement Areas: Addressing rising costs and maintaining Gross Margin

amid fluctuating commodity prices.

- Customer Profitability Analysis (CPA)

- Institutional Customers:

- Represent a significant

portion of revenues.

- Higher profitability due to

bulk purchases and long-term contracts.

- Individual Consumers:

- Lower profitability per

transaction but critical for brand equity.

- Strategies like targeted

promotions and loyalty programs enhance profitability.

- Cost Efficiency Measures:

- Leveraging economies of scale

and optimizing distribution networks.

Challenges and Opportunities

- Challenges:

- Volatility in commodity prices impacting margins.

- Increased operational expenses, including advertising

and travel.

- Opportunities:

- Expanding into new product categories and leveraging

the ConAgra affiliation.

- Enhancing digital marketing and e-commerce presence to

reach broader audiences.

Export

Trends and Analysis (Past Five Years)

Export Data

|

Year |

Export

Revenue (₹ crore) |

Growth

Rate (%) |

Key

Export Markets |

Major

Export Products |

|

2019-20 |

450.60 |

- |

Middle East, Southeast Asia |

Staples, spices |

|

2020-21 |

510.80 |

13.37 |

USA, UAE |

Processed foods, ready-to-eat

meals |

|

2021-22 |

589.10 |

15.31 |

Canada, Australia |

Organic ingredients, frozen foods |

|

2022-23 |

682.30 |

15.83 |

Europe, South Africa |

Health snacks, gluten-free

products |

|

2023-24 |

715.80 |

4.92 |

Emerging markets in Africa, Brazil |

Value-added products, health foods |

Key Observations

- Steady Revenue Growth:

Export revenue increased consistently, with double-digit growth in three

of the five years. The most significant growth occurred in 2022-23 at

15.83%.

- Geographical Expansion: Newer markets in Africa and South America contributed

to growth alongside established markets like the USA and Europe.

- Product Innovation:

Transition to value-added and health-focused products reflects adaptation

to global consumer trends.

Strategic Implications

- Increasing presence in emerging markets diversifies

risks and opportunities.

- Product innovation aligns with global trends, enhancing

the company's competitive edge.

- Export Growth:

The company has shown consistent growth in exports, especially in

processed food and ingredient categories, tapping into markets in

Southeast Asia, the Middle East, and North America.

- Key Export Products:

Staples, value-added food ingredients, and ready-to-eat snacks are the

primary contributors to export revenues.

- Emerging Markets:

The company is exploring opportunities in Africa and South America,

leveraging its affiliation with ConAgra Foods to penetrate these regions.

- Export Challenges:

- Fluctuating international commodity prices.

- Regulatory barriers and compliance issues in different

countries.

- Currency fluctuations impacting profitability.

- Opportunities in Exports:

- Expanding into organic and health-conscious product

segments.

- Building partnerships with international retail

chains.

- Utilizing free trade agreements to reduce export

tariffs.

- Digital Export Strategies:

- Enhancing the e-commerce platform for international

customers.

- Utilizing analytics to identify demand patterns and

optimize supply chains.

- Sustainability Initiatives:

- Promoting eco-friendly packaging for export products.

- Highlighting sustainable sourcing practices to attract

environmentally conscious consumers.

Strategic Recommendations

- Enhanced Consumer Engagement:

- Utilize ZMET insights to create emotionally resonant

marketing campaigns.

- Invest in storytelling that highlights the brand’s

heritage and quality.

- Operational Efficiency:

- Optimize advertising and travel expenditures by

focusing on digital channels.

- Implement advanced analytics for demand forecasting

and inventory management.

- Product Innovation:

- Introduce value-added products that cater to

health-conscious consumers.

- Explore partnerships with institutional customers for

co-branded offerings.

- Focus on sustainability initiatives by reducing

packaging waste and sourcing sustainably.

- Develop regional-specific flavors to cater to diverse

consumer tastes across India.

- Strengthen the loyalty program by integrating

personalized rewards based on purchase behavior.

- Enhance training programs for distributors and

retailers to ensure better product positioning.

- Implement a robust feedback mechanism to improve

customer service quality.

- Explore digital transformation initiatives like

AI-powered chatbots for customer interaction.

- Leverage social media influencers to build a stronger

online presence.

- Conduct workshops and seminars for institutional

clients to showcase product benefits.

- Expand the distribution network to tier-3 and rural

markets.

- Invest in research and development to create new

product categories.

- Offer bulk-buying discounts to attract institutional

clients.

- Collaborate with health experts to promote the

nutritional benefits of products.

- Diversify into complementary product categories such as

ready-to-eat meals.

- Monitor global food trends to adapt quickly to emerging

consumer preferences.

- Expand e-commerce platforms to include subscription

services for regular customers.

- Optimize logistics to reduce delivery times and costs.

- Develop co-marketing campaigns with health and wellness

brands.

Conclusion The company’s strategic approach has positioned it as a

leader in the Indian food industry. By leveraging consumer insights through

ZMET, maintaining a high Q-factor, and optimizing customer profitability, the

company can address market challenges and capitalize on growth opportunities.

Continued investment in innovation, operational efficiency, and digital

transformation will ensure sustained growth and profitability.

References

- Annual Report 2023-24

- Company Website: www.atfoods.com

- Zaltman, G. (1997). "ZMET: A New Market Research

Tool."

- ConAgra Foods Financial Reports

- Indian Food Industry Statistics 2023

- Marketing Science Journal (2023)

- Nielsen Consumer Insights Report

- Mintel Food and Drink Trends

- Commodity Price Analysis (2023)

- Advertising Age Insights (2023)

- Harvard Business Review: Customer Profitability

- Journal of Consumer Behavior (2023)

- McKinsey & Co. Reports on Food Sector

- KPMG Insights on Operational Efficiency

- Digital Transformation in FMCG Sector (2023)

- Ernst & Young Report on Q-Factor Analysis

- Economic Times: Food Industry Trends

- PwC Report on Food Marketing

- Deloitte Insights: Food Supply Chain

- Forrester Research: Consumer Engagement Strategies

Comments

Post a Comment