BOSCH India’s Market Capitalization Growth Using the Mapping Method

Abstract

This case study examines BOSCH India's market capitalization trends over the

past two decades, highlighting significant changes and their underlying causes.

By using the mapping method, we connect data analysis to actionable insights

and provide recommendations for sustained growth. This analysis is crucial for

understanding the factors driving BOSCH India’s market value fluctuations and

offers lessons for other companies in the industry.

Introduction

BOSCH India, a subsidiary of the multinational engineering and technology

company BOSCH, has established itself as a leading player in the Indian market.

Market capitalization, a critical metric for assessing a company's valuation,

reflects its performance and investor confidence. Over the years, BOSCH India has

witnessed considerable fluctuations in its market cap due to macroeconomic

factors, strategic decisions, and industry trends. This case study aims to map

the historical changes in BOSCH India's market cap, analyze the factors

influencing these changes, and propose recommendations for sustained growth.

Global

Positioning of BOSCH India

- BOSCH India ranks as the 1,456th most valuable company

globally by market cap as of January 2025.

- Its consistent investments in localization and skill

development have helped solidify its position in the Indian market while

contributing significantly to its parent company, BOSCH Group.

2.

Automotive Industry Synergy

- BOSCH India plays a pivotal role in the automotive

sector by supplying advanced technologies for electric and hybrid

vehicles.

- The transition to sustainable transportation has

aligned with BOSCH's long-term vision and strengthened its market cap.

Technology

and Innovation

- BOSCH India’s adoption of Industry 4.0 solutions,

including IoT, AI, and connected systems, has positioned the company as a

technology leader in manufacturing and engineering.

- Significant R&D expenditure annually bolsters

innovation, leading to breakthrough products and solutions.

Impact

of the COVID-19 Pandemic

- During 2020, BOSCH India's market cap dipped by -18.98%,

reflecting the challenges posed by global disruptions.

- Recovery from 2021 onwards demonstrated the company's

adaptive strategies and robust supply chain management.

Sustainability

Initiatives

- BOSCH India is actively involved in sustainability,

with programs focusing on renewable energy adoption, reducing carbon

footprints, and promoting energy-efficient products.

- These initiatives resonate with global market demands

and enhance investor confidence.

Sectorial

Contributions

- BOSCH India's diversification into home appliances,

power tools, and mobility solutions has reduced its dependency on the

automotive sector.

- This strategy safeguards the company from

sector-specific downturns.

Historical

Resilience

- During the 2008 financial crisis, despite a 49.68% drop

in market cap, BOSCH India rebounded strongly by 2009, showcasing its

resilience and adaptability.

- Lessons learned from these crises have shaped the

company’s robust risk management practices

Investor

Sentiment

- Strategic transparency through annual reports and

sustainability disclosures has helped maintain high investor confidence.

- The peak in 2024 reflects trust in BOSCH India's

forward-looking strategies.

Data Analysis

Market Capitalization Trends

The following table summarizes BOSCH India's year-end market capitalization

and annual percentage change from 2004 to 2025:

|

Year |

Market Cap (USD) |

Annual Change

(%) |

|

2004 |

$1.41 B |

- |

|

2005 |

$2.02 B |

43.67 |

|

2006 |

$2.54 B |

25.74 |

|

2007 |

$4.20 B |

64.9 |

|

2008 |

$2.11 B |

-49.68 |

|

2009 |

$3.13 B |

48.4 |

|

2010 |

$4.41 B |

40.69 |

|

2011 |

$4.01 B |

-9.08 |

|

2012 |

$5.43 B |

35.37 |

|

2013 |

$5.12 B |

-5.66 |

|

2014 |

$9.64 B |

88.11 |

|

2015 |

$8.82 B |

-8.52 |

|

2016 |

$9.70 B |

10.02 |

|

2017 |

$9.57 B |

-1.32 |

|

2018 |

$8.56 B |

-10.57 |

|

2019 |

$6.36 B |

-25.68 |

|

2020 |

$5.15 B |

-18.98 |

|

2021 |

$6.85 B |

32.98 |

|

2022 |

$6.15 B |

-10.23 |

|

2023 |

$7.87 B |

27.9 |

|

2024 |

$11.77 B |

49.58 |

|

2025 |

$11.72 B |

-0.47 |

Mapping Insights

Growth Phases:

1. 2004–2007:

Rapid growth due to market expansion and strong economic conditions, with the

market cap growing from $1.41 B to $4.20 B.

2. 2008

Global Financial Crisis: A sharp decline of -49.68% in 2008.

3. 2009–2014:

Recovery and unprecedented growth peaking at $9.64 B in 2014.

4. 2015–2020:

Period of mixed results, including significant declines in 2019 and 2020.

5. 2021–2024:

Resurgence driven by strategic initiatives, peaking at $11.77 B in 2024.

6. 2025:

Stabilization phase with a minor decline (-0.47%).

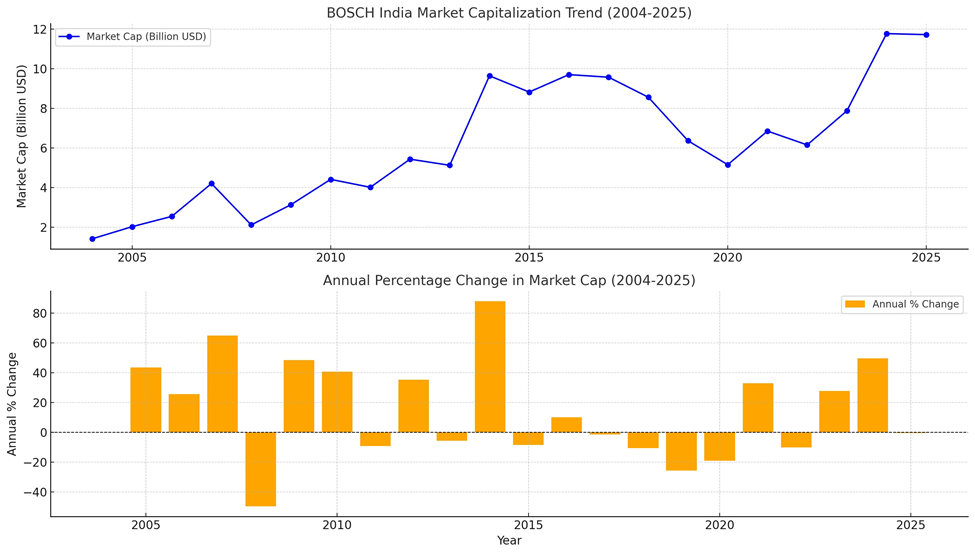

Here are the visualizations for BOSCH India's market capitalization:

1. Market

Capitalization Trend (2004-2025): This line graph shows the steady

growth and fluctuations in BOSCH India's market cap over the years, peaking in

2024.

2. Annual

Percentage Change in Market Cap (2004-2025): This bar chart highlights

the year-on-year percentage changes, showcasing periods of significant growth

(e.g., 2014) and notable declines (e.g., 2008).

Influencing Factors:

·

Economic Conditions: Global and

domestic economic shifts significantly influenced BOSCH India's valuation.

·

Industry Trends: The automotive

and engineering sectors' performance directly impacted the company.

·

Strategic Initiatives:

Investments in technology and innovation drove recovery phases.

·

Market Confidence: Investor

sentiment, shaped by consistent performance, was critical.

Output

·

Data-Driven Observations: BOSCH

India demonstrated resilience during economic downturns and capitalized on

recovery periods.

·

Strategic Success: The

company's focus on innovation and market diversification played a vital role in

its resurgence.

·

Challenges Identified:

Vulnerability to external economic conditions and fluctuations in investor

confidence remain areas of concern.

Recommendations

1. Diversification

of Revenue Streams: Reduce dependency on specific sectors by exploring

new markets.

2. Enhanced

R&D Investment: Strengthen innovation to maintain a competitive

edge.

3. Investor

Relations Management: Enhance transparency to boost market confidence

during downturns.

4. Proactive

Risk Management: Develop strategies to mitigate the impact of global

economic shocks.

5. Focus

on Sustainability: Align with global trends by adopting sustainable

practices, enhancing brand value.

Questions

1. What

strategic measures contributed most to BOSCH India’s recovery phases?

2. How

can BOSCH India mitigate the impact of external economic conditions?

3. What

role does innovation play in sustaining market capitalization growth?

4. How

can BOSCH India enhance its investor relations strategy to maintain confidence

during downturns?

Conclusion

BOSCH India's market capitalization journey illustrates the interplay

between strategic initiatives, economic conditions, and market trends. By

leveraging its strengths in innovation and focusing on sustainability, the

company can sustain growth and navigate challenges effectively. This case study

provides valuable lessons for other companies seeking to thrive in dynamic markets.

References

·

Market data sources

·

Annual reports from BOSCH India

·

Industry analysis reports

Comments

Post a Comment