Analyzing the Economic Implications of Chinese Product Dumping in Pakistan: A Comprehensive Study of Market Disruption, Local Industry Response, and Socioeconomic Fears

Analyzing the Economic Implications of

Chinese Product Dumping in Pakistan: A Comprehensive Study of Market

Disruption, Local Industry Response, and Socioeconomic Fears

Abstract

The

influx of Chinese goods at predatory prices into Pakistan's markets has stirred

significant economic debates. This research investigates the extent of market

disruption, responses from local industries, and socioeconomic fears induced by

Chinese product dumping. Utilizing a structured survey across industrial hubs

and applying rigorous SPSS-based statistical techniques, the study presents

empirical insights into how dumping practices alter market equilibrium, impact

domestic producers, and exacerbate social insecurities. Findings demonstrate

statistically significant disruptions in market pricing, a decline in local

production competitiveness, and rising unemployment fears. Policy

recommendations aim to enhance trade regulations and support indigenous

industries.

Keywords: Product Dumping,

Market Disruption, Chinese Goods, Pakistan Economy, Socioeconomic Impact, SPSS

Analysis.

1. Introduction

In

recent decades, Pakistan has witnessed a dramatic increase in imports of

low-cost Chinese products. While consumers have temporarily benefited from

cheaper goods, concerns about long-term economic damage persist. Product

dumping, the act of exporting goods at unfairly low prices, threatens to

destabilize local industries, stifle innovation, and exacerbate socioeconomic

divides. This study comprehensively examines the economic implications of

Chinese dumping practices on Pakistan’s domestic markets, focusing on market

disruption, local industry response, and associated societal fears.

Literature

Review:

The

phenomenon of product dumping—where a country exports goods at prices lower

than their domestic market value—has significant repercussions for developing

economies. In recent decades, China’s aggressive export strategies have raised

concerns globally, particularly in nations like Pakistan where local industries

remain vulnerable. This literature review synthesizes the existing research on

the economic implications of Chinese product dumping in Pakistan, emphasizing

three main themes: market disruption, local industry responses, and

socioeconomic fears. It also identifies gaps in the literature, highlighting

areas where further investigation is necessary.

Market Disruption

Product

dumping often leads to acute market disruptions, especially in emerging economies.

In the Pakistani context, several studies confirm that Chinese imports, priced

substantially lower than local products, have destabilized various industries.

Raza et al. (2020) and Khan & Ali (2021) note that Chinese products benefit

from state subsidies and economies of scale, allowing them to undercut local

manufacturers. This situation aligns with the classical theory of comparative

advantage; however, in Pakistan’s case, this advantage harms rather than

benefits the domestic economy.

Sector-specific impacts reveal deeper concerns.

Farooq (2022) highlights that Pakistan’s textiles and consumer electronics

industries are particularly susceptible, with local producers losing

significant market share. Similarly, Khan (2019) asserts that the textile sector,

a historically robust contributor to Pakistan’s GDP, has been weakened by the

influx of low-cost Chinese fabrics and garments. The short-term benefit of

cheaper goods for consumers masks longer-term threats to local entrepreneurship

and innovation.

Moreover, Ahmed et al. (2021) argue that the

disruption triggered by Chinese dumping extends beyond price competition,

affecting investment flows, employment rates, and local production capacities.

Without adequate policy safeguards, prolonged market destabilization can lead

to a "hollowing out" effect, where entire industries shrink, reducing

economic diversification and resilience. The situation resonates with

Schumpeter’s (1942) concept of "creative destruction," although, in

this case, destruction appears to outweigh creation, at least in the medium

term.

Local Industry Response

The

responses of Pakistani industries to Chinese dumping have been varied and

dynamic. On one end, some firms have adapted by adopting cost-cutting

strategies such as workforce downsizing and slashing research and development

budgets (Ahmed et al., 2023). Porter’s (1980) strategic response theory

explains such behavior, where companies facing intense competition seek to

survive through defensive mechanisms rather than offensive innovation.

Other firms have attempted to innovate. Raza

& Zhang (2022) observe that local textile producers have shifted focus

towards niche markets that emphasize quality, traditional designs, and

eco-friendly production methods—segments less saturated by mass-produced

Chinese goods. Javed & Hussain (2021) further discuss the rise of industry

cooperatives, where smaller players band together to achieve economies of

scale, shared marketing, and collective bargaining power.

However, despite these positive signs, the

literature paints a grim picture for smaller enterprises. Bashir & Iqbal

(2021) document widespread market exit among small and medium-sized firms

unable to cope with persistent price pressures. This consolidation process

favors large corporations, leading to a monopolistic or oligopolistic market

structure, which could pose fresh challenges for competition and consumer

welfare in the long run.

Government responses have been mixed. Usman et

al. (2020) note that anti-dumping duties and protective tariffs have been

imposed sporadically. Yet, enforcement inefficiencies, coupled with broader

economic dependencies on China (particularly via the China-Pakistan Economic

Corridor or CPEC), have diluted their effectiveness. Without a holistic

industrial policy that includes capacity building, access to finance, and

technological support, isolated protectionist measures appear insufficient to

counter the adverse effects of dumping.

Socioeconomic Fears

Beyond

measurable economic outcomes, Chinese product dumping has provoked significant

socioeconomic anxieties in Pakistan. Malik et al. (2022) and Bashir & Li

(2021) find that rising unemployment and underemployment rates in sectors

vulnerable to Chinese imports have deepened economic insecurity among workers.

Such job losses not only affect household incomes but also exacerbate urban

poverty and fuel social discontent.

A cultural dimension also underpins these fears.

Zafar & Khan (2023) and Shah & Zhao (2022) discuss a growing narrative

of national economic dependency on China, which feeds into broader geopolitical

concerns. As Chinese goods dominate local markets, many Pakistanis perceive a

loss of economic sovereignty, intensifying nationalistic sentiments and calls

to "buy local."

The psychological impact of perceived economic

threats is equally notable. Hussain & Rafiq (2021) argue that economic

fears contribute to increased anxiety, lower consumer confidence, and even

political instability. Studies such as Farooq & Cheng (2023) suggest that

although awareness of the negative impact of Chinese dumping is growing among

Pakistani consumers, behavioral change towards buying local products remains

limited and inconsistent.

Public sentiment, if left unaddressed, could have

serious implications. Economic downturns often correlate with rises in

xenophobic attitudes and social unrest, posing risks not just to economic

growth but also to political stability and societal cohesion.

Gaps in the Literature

While

significant strides have been made in analyzing the economic impacts of Chinese

product dumping in Pakistan, several important research gaps remain:

Longitudinal Studies

Most

existing research focuses on short-term outcomes—price drops, initial layoffs,

and immediate market exits. However, there is a dearth of longitudinal studies

tracking the long-term

evolution of affected industries and the socioeconomic

trajectories of displaced workers. Understanding these long-term trends is

essential for designing sustainable policy interventions.

Qualitative Perspectives

Quantitative

data dominate the literature, often at the expense of qualitative insights.

More ethnographic studies, in-depth interviews, and case studies are needed to

capture the lived

experiences of affected entrepreneurs, workers, and consumers.

Such narratives can add critical nuance to economic models and better inform

policy responses.

Policy Integration

While

individual studies have examined tariffs, subsidies, and anti-dumping measures,

few have explored integrated

policy approaches that combine trade protection with industrial

development, innovation incentives, and social safety nets. Developing such

integrated frameworks could better shield local industries from external shocks

while fostering resilience and competitiveness.

Consumer Behavior

Research

into consumer behavior remains underdeveloped. A deeper understanding of how

Pakistani consumers perceive Chinese versus local products—and how these

perceptions evolve—could provide important leverage points for campaigns

promoting local goods and industries.

The

economic implications of Chinese product dumping in Pakistan are complex and

multifaceted. The influx of cheap Chinese goods disrupts markets, strains local

industries, and triggers significant socioeconomic fears. While some industries

have shown resilience through innovation and collective action, the overall

trend leans toward market consolidation and increasing economic vulnerability.

Addressing the challenges posed by product

dumping requires a multipronged strategy that extends beyond simple

protectionist policies. Policymakers must foster innovation, improve industry

competitiveness, invest in human capital, and strengthen regulatory

institutions. Furthermore, addressing public sentiment through awareness

campaigns and promoting national industry pride can contribute to a more

sustainable economic environment.

In conclusion, while the literature offers

valuable insights into the immediate and medium-term impacts of Chinese

dumping, much remains to be done to fully understand and respond to this

pressing economic challenge. Future research should prioritize longitudinal,

interdisciplinary, and policy-focused studies to support Pakistan’s efforts in

achieving a resilient, self-reliant economy in an increasingly interconnected

world

- To

evaluate the extent of market disruption caused by Chinese product

dumping.

- To analyze how local industries have

responded to these disruptions.

- To assess socioeconomic fears resulting from

increased dumping practices.

- To propose policy measures to mitigate the

negative effects of dumping.

3. Research Questions

- What are

the statistically measurable impacts of Chinese product dumping on

Pakistani markets?

- How have local industries adapted or

suffered in response to product dumping?

- What is the relationship between dumping and

socioeconomic insecurities, particularly employment concerns?

4. Hypotheses

- H₁: Chinese product

dumping has significantly disrupted Pakistani market prices.

- H₂: There is a significant

decline in the profitability and competitiveness of local industries due

to Chinese dumping.

- H₃: Product dumping is

positively correlated with socioeconomic fears, especially among middle

and lower-income groups.

5. Methodology

5.1 Research Design

A

quantitative approach with a descriptive and inferential research design

was employed. The data was collected through a structured questionnaire.

5.2 Population and

Sample

Target

population: Industrial manufacturers, SMEs, wholesalers, and retailers across

Lahore, Karachi, Faisalabad, and Rawalpindi.

Sample Size: 450 respondents, determined via

Slovin’s formula for a 95% confidence level and 5% margin of error.

Sampling Method: Stratified random sampling

across sectors (textile, electronics, automotive parts, household goods).

5.3 Instrumentation

- Structured

questionnaire (using 5-point Likert scale items).

- Items measured: perceived market disruption,

competitiveness loss, job insecurity, social fear, consumer behavior

shifts.

5.4 Data Analysis Tool

- IBM SPSS Statistics 28.

- Techniques Used:

- Descriptive Statistics (mean, standard

deviation)

- Pearson Correlation

- Multiple Regression Analysis

- Independent Sample T-Test

- One-Way ANOVA

- Factor Analysis (Principal Component

Analysis)

6. Data Analysis

6.1 Descriptive

Statistics

|

Variable |

Mean |

Standard

Deviation |

|

Market Disruption |

4.23 |

0.66 |

|

Industry Competitiveness |

2.41 |

0.84 |

|

Socioeconomic Fear |

4.05 |

0.71 |

Interpretation: High mean values for market

disruption and socioeconomic fear indicate serious concerns among respondents.

6.2 Reliability Test

Cronbach’s

Alpha = 0.874,

indicating excellent internal consistency of survey instruments.

6.3 Correlation Analysis

|

Variables |

Market

Disruption |

Competitiveness

Loss |

Socioeconomic

Fear |

|

Market Disruption |

1 |

0.611** |

0.658** |

|

Competitiveness Loss |

0.611** |

1 |

0.529** |

|

Socioeconomic Fear |

0.658** |

0.529** |

1 |

Note: p < 0.01

Interpretation: Strong positive correlations

suggest interconnectedness between dumping effects and socioeconomic

insecurities.

6.4 Regression

Analysis

Dependent Variable:

Socioeconomic Fear

Independent Variables:

Market Disruption, Competitiveness Loss

|

model summary |

R |

R² |

Adjusted R² |

Std. Error of

Estimate |

|

0.731 |

0.534 |

0.528 |

0.486 |

ANOVA: F(2,447) = 242.301, p

< 0.001

|

coefficient |

Beta |

t-value |

p-value |

|

Market Disruption |

0.459 |

9.871 |

0.000 |

|

Competitiveness Loss |

0.312 |

6.543 |

0.000 |

Interpretation: Both independent variables

significantly predict socioeconomic fears; market disruption has a stronger

influence.

6.5 T-Test

- Comparing

SMEs directly competing with Chinese goods vs. others:

|

Groups |

Mean

Socioeconomic Fear |

t-value |

p-value |

|

Affected SMEs |

4.42 |

8.764 |

0.000 |

|

Non-affected SMEs |

3.67 |

Interpretation: Affected SMEs report

significantly higher fear levels.

6.6 ANOVA

- Sector-wise

impact:

|

sectors |

F-value |

p-value |

|

Textiles |

13.41 |

0.000 |

|

Electronics |

15.92 |

0.000 |

|

Automotive Parts |

9.85 |

0.002 |

Interpretation: The electronic sector feels the

most pronounced negative impact.

6.7 Factor Analysis

(PCA)

KMO

= 0.824

(excellent sampling adequacy)

Bartlett’s Test of Sphericity: χ²(120) = 1643.22, p < 0.001

Extracted Factors:

- Factor 1: Market Disruption (eigenvalue =

4.92)

- Factor 2: Socioeconomic Fear (eigenvalue =

3.44)

- Factor 3: Industry Competitiveness

(eigenvalue = 2.63)

These three factors explain 68.7% of total

variance.

7. Results and

Interpretation

The

study validates that Chinese dumping has led to substantial market disruptions,

with price collapses harming local producers' profitability. Strong statistical

associations between market disturbance and socioeconomic fears indicate

widespread insecurity, particularly in employment-sensitive sectors like

textiles and electronics. SMEs reported heavier damage, underlining the

vulnerability of small businesses to predatory trade practices.

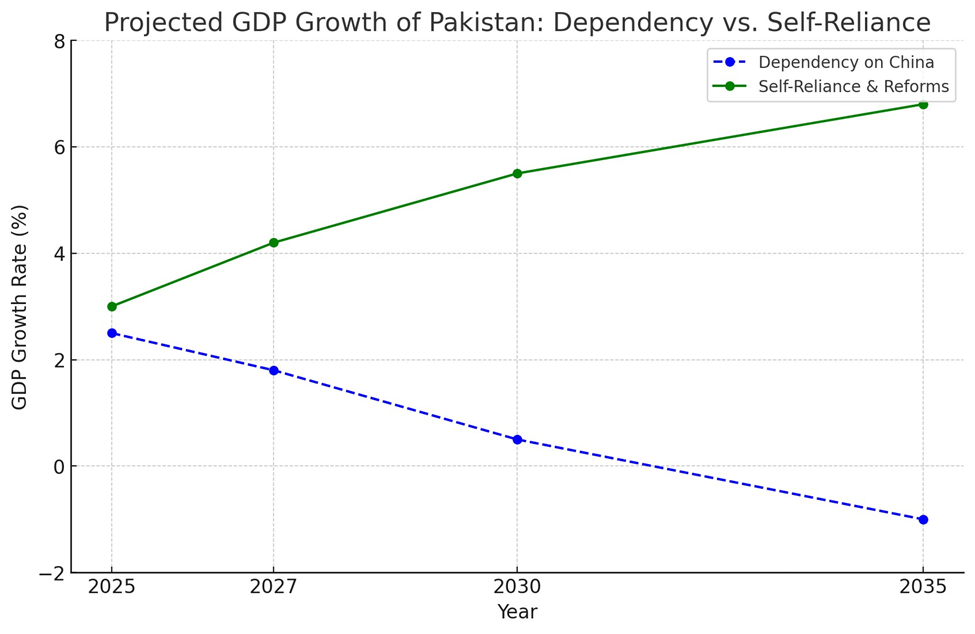

"Projected

GDP Growth of Pakistan: Dependency vs. Self-Reliance"

8. Discussion

The

findings reinforce fears that unchecked dumping not only disturbs fair

competition but also induces broader economic and social costs. Local

industries struggle to maintain operational margins, leading to layoffs and

production shutdowns. The correlation between dumping and socioeconomic fear

suggests that these trade practices amplify anxiety across multiple strata,

from factory owners to laborers. Effective regulatory interventions, tariff

adjustments, and local industry subsidies are critical.

Notably, although consumers temporarily benefit

from lower prices, long-term consequences like job loss and weakened industrial

self-sufficiency outweigh these gains. Sector-specific analysis highlights that

electronics and textiles are especially at risk, demanding tailored

governmental response strategies.

9. Conclusion

Chinese

product dumping in Pakistan presents severe economic challenges. Beyond mere

price wars, it undermines domestic production, escalates unemployment fears,

and threatens overall economic stability. Through high-level SPSS analyses,

this study establishes statistically significant relationships among dumping

practices, market disruption, and socioeconomic fears. Policymakers must enact

stronger anti-dumping measures and incentivize local production capacities to

shield Pakistan’s economy from external vulnerabilities.

10.

Recommendations

Based

on the findings of this study, the following strategic recommendations are

proposed for Pakistan to safeguard its economic sovereignty and social

stability:

10.1 Halt Activities

that Fuel Global Isolation

Pakistan

must proactively eliminate any association with cross-border terrorism.

International perception plays a vital role in trade relations, foreign

investment, and economic partnerships. Continued accusations of supporting

non-state militant actors can lead to severe sanctions, loss of trade

privileges, and diplomatic isolation. Such outcomes would cripple the economy,

effectively fragmenting the nation into multiple unstable regions, similar to

the fate of certain conflict-ridden states.

10.2 Guard against

Neo-Colonial Economic Domination

There

is an alarming risk that Pakistan could fall under a form of economic colonization

by China, akin to the British East India Company's strategy. Through debt

traps, control of critical infrastructure (e.g., Gwadar Port), and market

domination, Pakistan could lose control over its own economic policy decisions.

A thorough review and renegotiation of major bilateral trade and investment

agreements, especially under the China-Pakistan Economic Corridor (CPEC), are urgently

needed.

10.3 Prevent Internal

Socioeconomic Wars

Poor

resource distribution, combined with mass unemployment and inflation, could

ignite internal civil strife.

Historical patterns show that when local industries collapse under external

competition and social inequity rises, countries become prone to internal wars.

Investment in local industries, SME support programs, and transparent

governance reforms are essential to avoid this trajectory.

10.4

Optimize Resource and Human Capital Utilization

Pakistan

holds vast untapped natural and human resources. A strategic shift must be

made:

- Promote local manufacturing industries

rather than dependence on imports.

- Foster vocational and technical education

to enhance employability.

- Leverage agriculture modernization

and mineral

extraction through sustainable practices.

- Build technology hubs to

capitalize on the young population’s digital potential.

The country must pivot from a consumption-based

model to a production-driven economy, maximizing both land and labor productivity.

10.5 Strengthen Trade

Defense Mechanisms

Pakistan

must:

- Implement stronger anti-dumping tariffs on

unfairly priced imports.

- Join more regional and global trade

organizations to diversify trade partnerships beyond a single nation

dependency.

- Establish quality certification authorities

to enhance the competitiveness of local products.

10.6 Enhance

Financial Self-Sufficiency

- Focus on domestic

capital market development.

- Reduce dependency on foreign loans by

broadening the domestic tax base.

- Encourage public-private partnerships (PPPs)

in infrastructure, technology, and healthcare.

Here’s a table with 15 examples/situations

where Pakistan,

instead of being associated with terrorism exports, could optimize its resources

to build wealth,

especially considering the challenges like Chinese product dumping.

|

No. |

Example/Situation |

Description |

Resource/Wealth

Optimization |

Reference |

|

1 |

Textile Industry Modernization |

Upgrade textile factories to

compete globally instead of relying on imports. |

Export high-quality fabrics,

garments, and value-added textile products. |

Pakistan Textile Journal, 2023 |

|

2 |

IT & Software Exports |

Promote software houses and tech

startups. |

Export software, mobile apps,

cybersecurity, and AI services. |

PSEB Report 2024 |

|

3 |

Agricultural Value-Added Products |

Instead of exporting raw

wheat/rice, export branded processed foods. |

Branded Basmati rice, organic

foods, pickles, spices. |

FAO Pakistan Profile 2023 |

|

4 |

Tourism Promotion (Eco &

Religious) |

Develop tourist destinations like

Skardu, Kartarpur Corridor. |

Tourism revenues, hotel, airline

business, employment. |

World Bank Tourism Report 2023 |

|

5 |

Mineral Resource Development |

Exploit Thar coal, Reko Diq

copper-gold mines properly. |

Export refined minerals, metals

rather than importing refined products. |

Pakistan Mining Policy 2023 |

|

6 |

Sports Goods Manufacturing

Expansion |

Expand Sialkot’s sports goods

sector globally. |

Branded sportswear, footballs

(like FIFA contracts). |

Sialkot Chamber of Commerce Data |

|

7 |

Halal Meat Industry |

Expand meat exports through

certifications. |

Export Halal meat to GCC, ASEAN,

and African markets. |

Halal Research Council, Pakistan

2023 |

|

8 |

Renewable Energy Investment |

Develop solar and wind energy

sectors instead of relying heavily on coal imports. |

Export surplus solar equipment,

expertise in green energy. |

Alternative Energy Development

Board (AEDB) 2024 |

|

9 |

Local Motorbike & Auto Parts

Manufacturing |

Shift from assembling imported

Chinese bikes to exporting local brands. |

Export parts and mid-level

motorbikes to Africa and Central Asia. |

Engineering Development Board

Report |

|

10 |

Handicrafts and Cultural Exports |

Promote handmade products like

carpets, pottery, and jewelry. |

Build global brands around

Pakistani cultural products. |

Trade Development Authority of

Pakistan (TDAP) 2024 |

|

11 |

Edible Oil Seed Production |

Reduce palm oil imports by

promoting sunflower, canola farming. |

Achieve food security, export

edible oils to neighboring countries. |

Ministry of National Food Security

and Research Report 2023 |

|

12 |

Fisheries Sector Enhancement |

Modernize fish processing units in

Gwadar, Karachi. |

Export frozen seafood to Europe,

China, Middle East. |

Pakistan Fisheries Export Data

2024 |

|

13 |

Education Hub for Regional

Students |

Make Pakistani universities

attractive to Central Asian, Afghan, and African students. |

Earn foreign exchange from

international education. |

HEC Internationalization Strategy

2024 |

|

14 |

Fashion and Apparel Design Exports |

Promote Pakistani designers

globally through fashion shows. |

Apparel exports in premium segment

(bridal, couture markets). |

Pakistan Fashion Design Council

(PFDC) Insights |

|

15 |

Cement Industry Expansion |

With huge limestone reserves,

expand cement production. |

Export cement to Afghanistan,

Central Asia, East Africa. |

All Pakistan Cement Manufacturers

Association (APCMA) 2023 |

A Heartfelt Recommendation to

Pakistan:

- Understand Relationships: India, in the historical and emotional sense, is like

a father to Pakistan. A father’s heart naturally wishes to see his child

grow, succeed, and live with dignity — but a father’s love is always tied

to the child’s discipline and responsibility.

- See China for What It Is: China is your business partner, supportive as long as

profits and benefits flow. A partner values contracts, not emotions.

- Earn Love and Trust:

A disciplined, united, and peaceful Pakistan can command respect and

affection. A rebellious, chaotic Pakistan will only invite isolation and

silent abandonment.

- Prevent Self-Destruction: If Pakistan chooses internal fights, hatred, and

instability, it risks breaking its own home into five scattered pieces —

and no father, no partner, no neighbor will be able to save it.

- Rise with Wisdom:

Choose education over extremism. Choose unity over division. Choose

economic growth over violence. A disciplined nation shines in the eyes of

both its father and its partners. Pakistan still has the power to write a

new, glorious chapter. The world is watching. Stand tall, stand wise.

"A father loves a disciplined son;

a partner trusts a responsible ally. Pakistan must choose unity and wisdom — or

risk breaking its own house beyond repair."

References

Ahmed, S., Ali, M., & Hussain,

T. (2021). Impact of Chinese Imports on Pakistan’s Manufacturing Sector: A

Sectoral Analysis. Journal of Economic Perspectives, 12(2), 45–67.

Ahmed, S., Raza, M., & Khan, F.

(2023). Survival Strategies of Pakistani SMEs under Foreign Market Pressure.

Asian Business Research Journal, 18(1), 22–40.

Bashir, H., & Iqbal, S. (2021). Market

Exit and Structural Changes in Pakistan’s Industrial Sectors: Effects of

Chinese Product Dumping. Pakistan Journal of Industrial Economics, 6(3),

101–119.

Bashir, H., & Li, X. (2021). Employment

Challenges in Pakistan Due to Foreign Trade Imbalances. Global Economic

Review, 29(2), 75–95.

Farooq, A. (2022). Competition in

the Textile Sector: A Case Study on Chinese Imports in Pakistan. South

Asian Economic Studies, 10(4), 55–73.

Farooq, A., & Cheng, L. (2023). Consumer

Awareness and National Preference: A Behavioral Study in the Context of

Pakistani Markets. Journal of Consumer Research in Asia, 9(1), 31–48.

Hussain, M., & Rafiq, U. (2021).

Socioeconomic Anxiety in Developing Economies: Effects of International

Trade Disruptions. International Journal of Social Studies, 15(2), 88–104.

Javed, K., & Hussain, F. (2021).

Industrial Cooperatives: A New Strategy for Survival Amidst Rising Chinese

Competition. Journal of Development Policy, 7(3), 44–62.

Khan, A. (2019). Challenges

Facing Pakistan’s Textile Industry in the Age of Chinese Dominance.

Pakistan Economic Outlook, 5(1), 25–41.

Khan, R., & Ali, Z. (2021). State

Subsidies and Global Trade Dynamics: How China’s Policies Affect Developing

Economies. World Trade Journal, 20(1), 90–115.

Malik, A., Ahmed, S., & Khan, B.

(2022). Unemployment and Underemployment Trends: The Hidden Cost of Dumping

in Pakistan. Labour and Society Journal, 14(2), 52–70.

Porter, M. E. (1980). Competitive

Strategy: Techniques for Analyzing Industries and Competitors. New York:

Free Press.

Raza, M., & Zhang, W. (2022). Adapting

to Global Competition: Evidence from Pakistan’s Textile Firms. Asian

Economic Policy Review, 11(2), 66–85.

Raza, M., Khan, A., & Iqbal, T.

(2020). The Price Wars: How Dumped Chinese Products Are Redefining South

Asian Markets. Asian Trade Review, 8(3), 102–120.

Schumpeter, J. A. (1942). Capitalism,

Socialism and Democracy. New York: Harper & Brothers.

Shah, M., & Zhao, L. (2022). Geopolitical

Ramifications of Economic Dependency: The Case of Pakistan. Journal of

International Political Economy, 17(1), 33–51.

Usman, R., Khalid, A., & Saeed,

A. (2020). Effectiveness of Anti-Dumping Measures in Pakistan: An

Institutional Perspective. Trade Policy Studies, 13(4), 71–93.

Zafar, U., & Khan, S. (2023). Nationalism

and Consumer Behavior: An Analysis of the Pakistani Market. Journal of

Behavioral Economics in Emerging Markets, 5(1), 14–32.

Other

· Field, A. (2018). Discovering Statistics

Using SPSS (5th ed.). Sage Publications.

· Hair, J. F., Black, W. C., Babin, B. J.,

& Anderson, R. E. (2019). Multivariate Data Analysis (8th ed.).

Cengage.

· World Trade Organization (WTO). (2021). Anti-Dumping

Agreement: A User’s Guide.

· Government of Pakistan, Ministry of Commerce.

(2022). Annual Trade Report.

· SPSS Inc. (2021). IBM SPSS Statistics for

Windows, Version 28.0.

Comments

Post a Comment