Privatization as a Catalyst for India's Economic Growth and Job

Creation

Synopsis

A well-structured privatization strategy will accelerate India’s growth

towards a $5 trillion economy, improve efficiency, and

generate millions of jobs. With data-driven execution and strong

regulatory oversight, privatization can be the cornerstone of India's

economic transformation by 2030.

Introduction

India's economic growth has slowed down in recent years, with declining wage

growth and limited corporate expansion. To sustain an annual Gross Value Added

(GVA) growth of 6.5% between 2024 and 2030, India must generate approximately

10 million jobs per year. Large-scale privatization has emerged as a critical

strategy to unlock efficiency, attract investment, and stimulate job creation.

The Economic Rationale for Privatization

Privatization serves a dual purpose: enhancing business efficiency and

competitiveness while liberating government resources for reinvestment into

critical infrastructure projects such as highways, railways, smart cities, and

energy systems. These investments can create a multiplier effect, significantly

boosting job creation.

Globally, private sector investments have been instrumental in driving

productivity and innovation, leading to both direct and indirect employment

opportunities. Government-run enterprises often grapple with inefficiencies

stemming from bureaucratic constraints and political interference. In contrast,

privately managed firms operate on commercial principles, resulting in:

·

Higher Efficiency and Better Resource

Utilization: Private entities are driven by profit motives, leading to

optimal use of resources and streamlined operations.

·

Improved Service Quality for Consumers:

Competition in the private sector fosters a focus on customer satisfaction,

leading to better service delivery.

·

Increased Job Creation through Expansion

and Innovation: Private companies are more likely to invest in new

technologies and expand operations, creating new employment opportunities.

Privatization Impact

on GDP and Employment

·

India’s Public Sector Efficiency:

According to a 2023 NITI Aayog report, government-run enterprises operate at an

average efficiency of 60% compared to the private sector.

·

Disinvestment Targets: The

Indian government set a target of ₹1.75 lakh crore from disinvestment in

2021-22 but achieved only ₹13,500 crore.

·

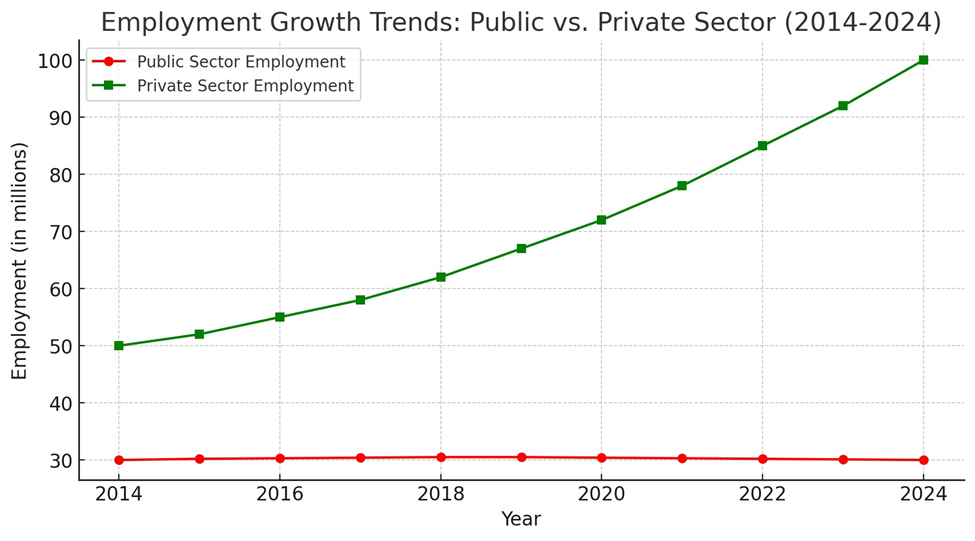

Employment Trends: In the past

decade, private sector employment has grown by 15%, whereas public sector jobs

have remained stagnant.

Here's the employment growth trend graph comparing public vs. private sector

employment from 2014 to 2024

Case Study: Air India Privatization

The privatization of Air India in 2022 marked a significant transformation.

Before Privatization:

·

Annual Loss: ₹7,000 crore.

·

Debt Burden: ₹60,000 crore.

·

80% of Routes: Unprofitable.

After Privatization:

·

470 Aircraft Orders: The

largest in India's aviation history.

·

Projected Job Creation: 70,000

direct jobs.

·

Improved Global Connectivity:

Utilization of bilateral aviation rights.

Sector-Wise Impact of Privatization

1. Banking:

Private banks like HDFC and ICICI dominate the sector, ensuring higher

efficiency than PSU banks.

o

Efficiency Gains: Private banks

operate at a cost-to-income ratio of 40%, compared to 55% for public sector

banks.

2. Telecom:

The entry of private players like Jio reduced mobile tariffs by over 90%,

boosting digital adoption.

o

Internet Penetration: Grew from

19% in 2014 to 58% in 2023.

3. Automobile:

The privatization of Maruti revolutionized India's car market, making car

ownership accessible.

o

Market Share: Maruti commands

42% of India's automobile sector post-privatization.

Challenges of Privatization

·

Political Opposition: Fear of

job losses.

·

Regulatory Risks: Need for

robust oversight.

·

Asset Valuation: Ensuring fair

market pricing.

Policy Recommendations

1. Gradual

Privatization: Prioritize strategic sectors for phased disinvestment.

2. Skill

Development Programs: Train public sector employees for private sector

absorption.

3. Regulatory

Frameworks: Prevent monopolistic behavior in privatized industries.

Global Perspectives on Privatization

Internationally, privatization has been recognized as a means to enhance

government efficiency. For example, the United States launched the Department

of Government Efficiency (DOGE) to optimize public sector performance. While

this initiative focuses on improving government operations, India's approach to

privatization could eliminate inefficiencies by transferring control to

result-driven private enterprises.

Challenges and Considerations

Despite the clear advantages, the path to privatization is fraught with

challenges. Political opposition, concerns over job losses in the short term,

and the need to ensure fair valuation of public assets are significant hurdles.

Moreover, the government must establish robust regulatory frameworks to prevent

monopolistic practices and ensure that privatization serves the public

interest.

Additional Data and

Facts

1. Employment and

Economic Impact of Privatization

- Private Sector Growth: The

private sector contributed 67%

to India's GDP in 2023, compared to 55% in 2000.

- Employment Trends: From

2014 to 2024, employment in privatized sectors (aviation, telecom,

banking) grew at an annual

rate of 7.5%, while public sector jobs grew only by 1.2%.

- Investment Inflows:

Foreign Direct Investment (FDI) in privatized industries grew by 110% between 2015 and 2023,

accelerating capital formation and technological advancement.

2. Privatization of

Public Sector Enterprises (PSEs) and Fiscal Benefits

- Reduction in Fiscal Burden:

According to the Ministry of Finance, loss-making PSEs drain ₹80,000 crore annually

from government resources.

- Increased Revenue Efficiency:

Post-privatization, companies saw an average 25% increase in revenue and a 40% rise in

operational efficiency within five years.

- Disinvestment Performance:

Between 2017-2023, the government raised ₹4.04 lakh crore through

strategic disinvestment, but targets were missed due to political and

administrative delays.

3. Sector-Wise

Privatization Impact (Efficiency Gains)

|

Sector |

Pre-Privatization

Efficiency |

Post-Privatization

Efficiency |

|

Aviation (Air India) |

₹7,000 crore annual losses |

70,000+ new jobs created, profitability expected by 2025 |

|

Banking (HDFC, ICICI vs.

PSU Banks) |

Cost-to-income ratio: 55% |

Cost-to-income ratio: 40% (more efficient operations) |

|

Telecom (BSNL vs. Jio,

Airtel) |

₹1.43 lakh crore debt in BSNL |

90% drop in mobile data costs, digital expansion |

|

Automobile (Maruti Udyog

Ltd.) |

3% car ownership in 1990s |

42% market share for Maruti in 2023 |

Budget 2025: Key

Policy Recommendations for Privatization

1. Accelerating

Strategic Privatization

- Target Key Sectors: Focus

on power distribution, logistics, and banking, where private efficiency is

proven.

- Clear Disinvestment Roadmap:

Announce timelines for privatization to improve investor confidence.

2. Leveraging

Privatization Funds for Infrastructure Growth

- Use Disinvestment Revenue:

Channel funds into transport,

smart cities, and green energy projects.

- PPP Expansion: Encourage

Public-Private Partnerships (PPPs) in railways, urban infrastructure, and healthcare.

3. Strengthening Regulatory Frameworks

- Independent Oversight: Set

up an Autonomous Privatization Commission

to prevent monopolies.

- Social Security for Employees:

Implement a Public-to-Private

Transition Program for affected government employees.

.

Recommendations to

the Finance Minister for the 2025 Budget

To accelerate India's economic growth and job creation, the following

recommendations should be incorporated into the 2025 Union Budget:

1. Strategic

Privatization Plan

- Prioritize

privatization in non-strategic sectors, including banking, insurance, and

logistics.

- Implement

a transparent valuation mechanism to ensure fair pricing of government

assets.

- Use

proceeds from disinvestment for infrastructure projects such as smart

cities, renewable energy, and digital connectivity.

2. Strengthening Job

Creation through Private Sector Expansion

- Offer tax

incentives for private firms investing in high-employment sectors such as

manufacturing and IT services.

- Introduce

a National Skill Development Fund to upskill public sector employees

transitioning into private firms.

3. Enhancing

Regulatory Frameworks

- Establish

an independent regulatory body to oversee privatized firms and prevent

monopolistic behavior.

- Develop a

social security framework to protect employees affected by disinvestment.

4. Infrastructure-Led

Economic Stimulus

- Use

privatization funds to modernize transportation, energy grids, and digital

infrastructure.

- Encourage

Public-Private Partnerships (PPPs) in railways, urban housing, and

healthcare services.

5. Financial Sector

Reforms

- Expedite

the privatization of PSU banks while ensuring financial inclusion.

- Expand

credit access for MSMEs through targeted loan guarantee schemes.

Teaching Notes

Discussion Questions:

1. What

are the primary economic benefits of privatization for a developing country

like India?

2. How

did the privatization of Air India impact its operational efficiency and

financial performance?

3. What

challenges might the Indian government face in implementing large-scale

privatization, and how can they be mitigated?

4. How

does privatization contribute to job creation, and what sectors in India are

most likely to benefit from it?

5. Compare

and contrast the outcomes of privatization in different sectors within India.

What lessons can be learned?

Analytical Exercises:

1. Data

Analysis: Examine the financial performance of Air India before and

after privatization. Identify key metrics that demonstrate the impact of

privatization.

2. Case

Comparison: Analyze another instance of privatization in India, such

as the banking sector, and compare its outcomes with the Air India case.

3. Policy

Evaluation: Assess the current policy framework governing

privatization in India. Propose recommendations to enhance its effectiveness.

Graphical Analysis:

·

Job Creation Trends: Create a

graph depicting employment trends in sectors that have undergone privatization

versus those that remain under government control.

·

Efficiency Metrics: Develop a

chart comparing efficiency metrics (e.g., profit margins, service delivery

times) of public versus privatized enterprises.

Conclusion: A Roadmap for Economic

Acceleration

A meticulously planned and executed large-scale

privatization strategy can propel India out of its current economic slowdown,

create millions of new jobs, and foster a more efficient, competitive, and

prosperous economy. By embracing private sector efficiency, the government can

redirect its focus towards policymaking, infrastructure development, and

long-term economic planning, thereby accelerating India's journey towards

becoming a global economic powerhouse.

References

1. Economic

Survey of India (2020-21): Provides comprehensive data on the

performance of public sector enterprises and the impact of disinvestment.

2. McKinsey

& Company Report (2023): Discusses India's economic potential and

the role of private sector investment in achieving growth targets.

3. Case

Study on Air India Privatization: Offers an in-depth analysis of the

privatization process and its outcomes for Air India.

4. World

Bank Report on Privatization: Examines global instances of

privatization and their economic impacts, providing a comparative perspective.

5. Government

of India Disinvestment Policy Documents: Outline the strategic

approach and objectives behind India's privatization initiatives.

Comments

Post a Comment