Case Study: Zee Entertainment

Enterprises Limited (ZEEL) vs. Star India - A Clash Over ICC Contract

Abstract

The legal battle between Zee

Entertainment Enterprises Limited (ZEEL) and Star India over a failed

International Cricket Council (ICC) broadcasting contract has brought

significant attention to the dynamics of media rights, corporate strategies,

and arbitration. Star India, backed by Reliance Industries Limited (RIL), has

claimed $940 million in damages, alleging that ZEEL breached its contractual

obligations. In retaliation, ZEEL has filed a counterclaim of $8 million plus

interest, citing its financial and reputational losses. This case study delves

into the financial, strategic, and legal aspects of the dispute, providing an

in-depth analysis supported by visual data representation. It also highlights

the broader implications for stakeholders, media companies, and the arbitration

landscape in India.

Background

of the Case

The

ICC Contract and its Significance

The ICC broadcasting rights are

among the most coveted assets in the global sports and entertainment industry,

providing exclusive access to a large and dedicated audience base. The ICC’s

tournaments, including the Cricket World Cup, generate massive advertising

revenues and subscription sales for broadcasters.

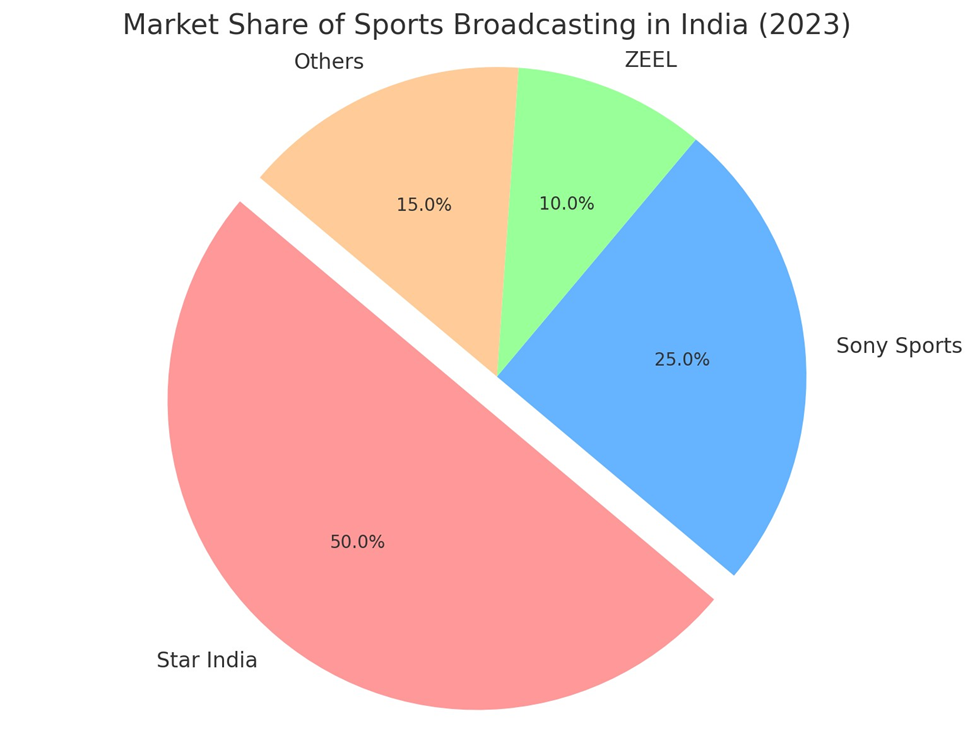

- Market Context:

- The Indian sports broadcasting market is estimated to

be worth over $1.4 billion annually, with cricket accounting for a

majority of this revenue.

- The ICC’s rights are instrumental in shaping a

broadcaster’s brand, audience loyalty, and revenue streams.

- The Dispute:

- Star India alleges that ZEEL’s failure to honor

specific contractual terms caused substantial financial harm, leading to

a claim of $940 million in damages.

- ZEEL has countered with an $8 million claim,

attributing its losses to Star’s alleged wrongful actions during the

contractual relationship.

Strategic

Context of the Dispute

- Star India:

Backed by RIL, Star India has been aggressively expanding its footprint in

the Indian and global media markets. Securing the ICC rights was a

strategic move to dominate the sports broadcasting segment.

- ZEEL:

Known for its diverse content portfolio, ZEEL’s involvement in the ICC

contract reflected its ambition to expand its sports broadcasting

division. The fallout from this dispute could undermine its strategic

objectives.

Graph:

Market Share of Sports Broadcasting in India (2023)

Note

: 2024 data are not availed

Expanded

Analytical Insights

Financial

Analysis

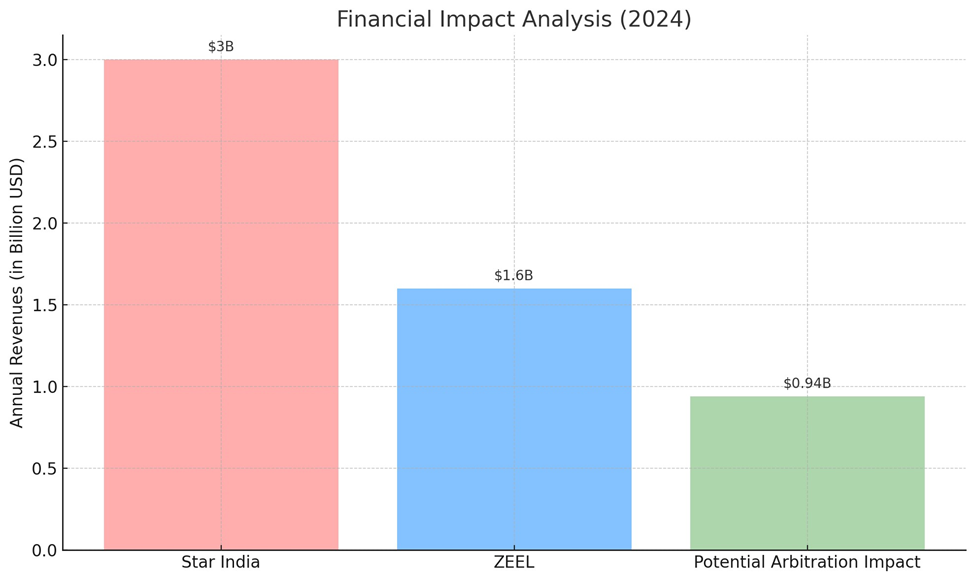

- Star India’s Claim:

- The $940 million claim represents nearly two-thirds of

the annual revenues Star India generates from cricket broadcasting.

- This claim underscores the financial stakes involved

and highlights the reliance of broadcasters on marquee events like ICC

tournaments.

- ZEEL’s Counterclaim:

- ZEEL’s $8 million counterclaim, though smaller in

magnitude, reflects the tangible losses it attributes to Star India’s

alleged actions.

- Legal costs and reputational damage are key components

of this counterclaim.

Strategic

Implications

- For ZEEL:

- The dispute threatens to erode investor confidence,

particularly as ZEEL navigates broader challenges in a competitive media

landscape.

- If unsuccessful, the financial burden of the

arbitration could disrupt its expansion plans.

- For Star India:

- A favorable outcome could solidify Star India’s

position as the dominant player in Indian sports broadcasting.

- However, prolonged litigation poses a risk of diverting

attention from other strategic initiatives, especially with RIL’s growing

focus on digital platforms.

Graph:

Financial Impact Analysis

Arbitration

Analysis

- The London Court of International Arbitration (LCIA)

has a strong reputation for neutrality and efficiency in handling complex

international disputes. Key considerations in this case include:

- The interpretation of contractual obligations and

whether ZEEL’s actions constitute a breach.

- The quantification of damages and their alignment with

actual financial losses incurred.

Broader

Industry Implications

- This dispute sets a precedent for the handling of

high-value media contracts in India.

- It underscores the growing role of arbitration in

resolving international business conflicts, especially in the

fast-evolving entertainment sector.

- A potential increase in litigation costs may prompt

companies to re-evaluate risk management strategies and contract drafting

practices.

Discussion

Questions

- What are the key contractual elements that might

influence the arbitration decision?

- How could the outcome of this case impact the financial

strategies of ZEEL and Star India?

- Discuss the role of arbitration in resolving

high-stakes corporate disputes.

- What lessons can other broadcasters learn from this

legal conflict?

- How might Reliance Industries Limited leverage this

case to strengthen its media foothold?

Teaching

Notes

Learning

Objectives

- To analyze the financial and legal complexities of

high-value corporate disputes.

- To understand the role of arbitration in resolving

international business conflicts.

- To evaluate the strategic implications of litigation on

stakeholders.

Key

Takeaways

- Corporate disputes often involve a mix of legal,

financial, and strategic considerations.

- Arbitration can provide a structured mechanism for

dispute resolution but comes with significant costs and risks.

- Stakeholders must balance short-term losses against

long-term strategic goals.

Classroom

Activities

- Role Play:

Assign roles to students as representatives of ZEEL, Star India, and the

LCIA arbitrator to simulate a mock arbitration hearing.

- Case Analysis:

Ask students to prepare a SWOT analysis for both ZEEL and Star India based

on the case.

- Debate:

Organize a debate on the effectiveness of arbitration versus litigation in

resolving corporate disputes.

Conclusion

The ZEEL vs. Star India arbitration exemplifies the

intricate interplay between business, law, and strategy. As the case unfolds,

it will not only determine the financial outcomes for the involved parties but

also set a precedent for future disputes in the Indian media and entertainment

industry. Sebi rejected the settlement applications by Zee Entertainment

Enterprises and Punit Goenka, and referred the matter for further

investigation. The order also stated that the show-cause notices issued against

Zee, Subhash Chandra, and Punit Goenka will be merged with the ongoing

investigation. This follows the termination of Zee's deal with Sony and a

significant decline in Zee's stock.

References

- ZEEL regulatory filings (available on the Bombay Stock

Exchange website).

- Reports on Indian cricket broadcasting market (PwC and

KPMG).

- London Court of International Arbitration (LCIA) case

summaries.

- Industry analysis reports on Reliance Industries

Limited’s media investments.

- News articles from The Economic Times, Business

Standard, and Mint.

Comments

Post a Comment