Case Study: Essar Group’s Export Trends and Market

Opportunities

Abstract

This case study examines the export trends, market opportunities, and

strategic decision-making models of the Essar Group, a multinational

conglomerate with diversified business interests spanning steel, energy,

infrastructure, and services. It highlights the group’s pivotal role in India’s

international trade through its robust export operations, particularly in

energy and agricultural sectors.

The study analyzes Essar’s export contributions in

FY23-24, including top markets such as Canada and New Zealand, and major

product categories like refined petroleum products, fruits, and vegetables. It

explores non-compensatory purchase decision-making models, emphasizing product quality, timely delivery, and regulatory compliance

that drive customer satisfaction. Additionally, the study delves into the

challenges Essar faced, including its delayed refinery project in the 1990s,

and how resilience and adaptability shaped its operational strategies.

Graphs visualizing export distribution and product contributions add depth,

while teaching notes and discussion questions foster a deeper understanding of

Essar’s strategies and challenges. This comprehensive analysis offers valuable

insights for students, professionals, and academicians studying international

trade and corporate resilience.

Overview

of Essar Group

The Essar Group, established in

1969, has evolved into a leading multinational conglomerate with diversified

business interests, including steel, energy, infrastructure, and services.

Leveraging its strong network of subsidiaries and strategic partnerships, Essar

has made significant strides in the import-export domain, cementing its

position as a key player in international trade.

Export

Trends

Total

Export Shipments and Value (FY23-24)

- Total Export Shipments: 179,784.26

- Total Export Value:

$220 million

Top

Export Markets (FY23-24)

- Canada:

$84,426

- Hong Kong:

$13,904

- New Zealand:

$17,278

Major

Export Product Categories and HSN Codes:

- HSN Code: 08109090

– Product Description: Fresh and Dried Fruits (e.g., mangoes, bananas, and

other tropical fruits)

- HSN Code: 07099990

– Product Description: Miscellaneous Vegetables (e.g., green chilies,

drumsticks, and okra)

- HSN Code: 14049040

– Product Description: Non-edible Plant Materials (e.g., seeds and herbs

for industrial purposes)

- HSN Code: 08045026

– Product Description: Fresh and Frozen Nuts (e.g., cashews, almonds)

- HSN Code: 07031020

– Product Description: Root Vegetables (e.g., onions and garlic)

·

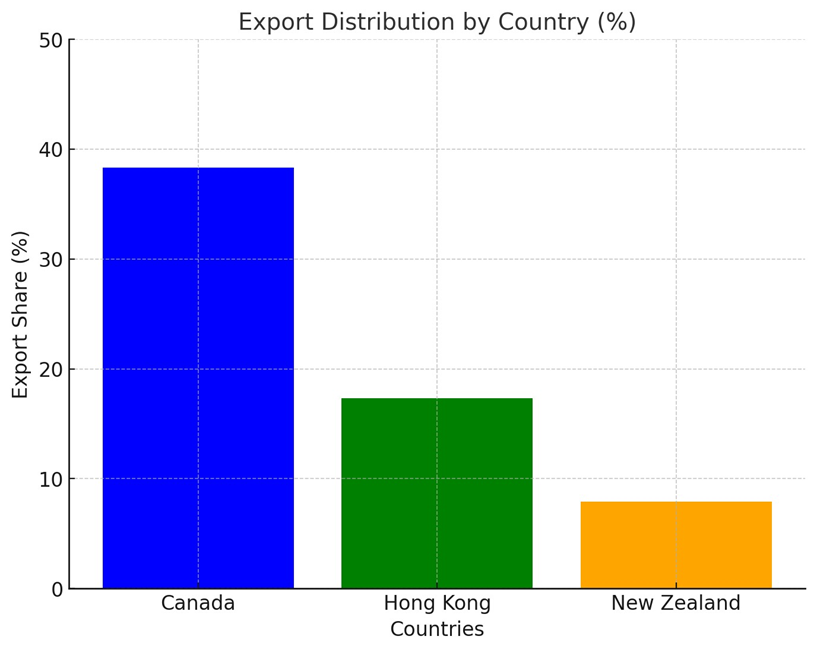

Export Distribution by Country: A bar chart showcasing the share

of exports to Canada, Hong Kong, and New Zealand.

· Product Category Contribution: A pie chart illustrating the percentage contribution of major product categories based on their HSN codes.

- Fruits (HSN Code: 08109090): 35%

- Vegetables (HSN Code: 07099990): 25%

- Nuts (HSN Code: 08045026): 20%

- Root Vegetables (HSN Code: 07031020): 15%

- Non-Edible Plant Materials (HSN Code: 14049040): 5%

Here is the line graph showing the

export growth of Essar Group over the past decade (2014–2024).

Sector

Contribution

Essar’s energy exports, including

gasoline, diesel, and liquefied petroleum gas (LPG), have been pivotal in

boosting India’s export revenue. The group’s state-of-the-art infrastructure

facilities, such as refineries and terminals, ensure efficient production and

transportation of these products.

Market

Opportunity Analysis

Key

Drivers:

- Technological Advancements: Essar’s adoption of innovative technologies in

logistics and supply chain management ensures the seamless movement of

goods, enhancing customer satisfaction.

- Strategic Location:

Facilities in Gujarat’s Jamnagar provide proximity to key shipping routes,

enabling efficient global distribution.

- Diversified Product Portfolio: Essar’s exports span multiple categories, from

agricultural products to refined petroleum, catering to diverse market

needs.

Opportunities

for Growth:

- Emerging Markets:

With growing demand in regions like Southeast Asia and Africa, Essar can

expand its footprint by leveraging its expertise in energy and steel.

- Sustainability Initiatives: Global trends favor companies focusing on eco-friendly

practices. Essar’s emphasis on innovation positions it well to tap into

the green energy sector.

- Infrastructure Expansion: Investing in advanced logistics hubs can streamline

export operations, reducing costs and delivery times.

Non-Compensatory

Models in Decision-Making at the Point of Purchase

Essar’s success in exports is partly

attributed to understanding and implementing non-compensatory decision-making

models. These models focus on customer preferences where certain criteria are

non-negotiable:

Examples

in Action:

- Product Quality as a Baseline: Essar’s high-quality refined petroleum products ensure

repeat business, as buyers prioritize quality over cost.

- Timeliness in Delivery: Efficient supply chain systems guarantee adherence to

delivery timelines, a non-compensatory factor for international buyers.

- Regulatory Compliance: Ensuring adherence to international trade regulations

and standards is critical, as non-compliance can be a deal-breaker.

- Strategic Partnerships:

Collaborating with international logistics providers ensures seamless

delivery, a critical factor for clients

Historical

Challenges and Resilience

The late Shashi Ruia’s vision faced

challenges during the group’s refinery project in the late 1990s. Delayed by a

cyclone and financing hurdles, Essar’s refinery began operations in 2006 with a

capacity of 7.5 million tonnes per annum. Despite setbacks, the group

persevered, learning resilience and adaptability, which continue to define its

operations today.

Global

Impact of Essar’s Exports

- Energy Sector Contributions: Essar’s refined petroleum exports significantly

support global energy demands, especially in countries with limited

refining capacity. This positions Essar as a vital partner in the global

energy supply chain.

- Sustainability and Innovation: By incorporating green technologies in its refineries

and logistics, Essar addresses the growing demand for sustainable energy

solutions, setting itself apart in international markets.

Key

Partnerships and Collaborations

- Strategic Alliances:

Essar’s partnerships with major international logistics and shipping

companies streamline the global distribution process, ensuring timely

delivery and reducing operational costs.

- Government Collaborations: By working closely with Indian and international trade

bodies, Essar aligns with regulatory requirements, enhancing its export

credentials.

Economic

Contributions

- Boost to Indian Economy: Essar’s exports contribute to India’s GDP,

particularly in energy and agricultural sectors, showcasing its role as a

significant economic driver.

- Job Creation:

The group’s operations create employment opportunities across logistics,

manufacturing, and export management.

Technological

Edge

- AI and IoT in Logistics: Essar employs advanced technologies like artificial

intelligence (AI) and the Internet of Things (IoT) to optimize supply

chain operations, reducing delays and improving efficiency.

- Blockchain in Trade Compliance: Blockchain integration ensures secure and transparent

trade documentation, bolstering trust with international partners.

Export

Trends in a Global Context

- Shift Toward Emerging Markets: Countries in Africa and Southeast Asia have shown

increased demand for Essar’s products, presenting new avenues for growth.

- Global Economic Trends: Fluctuations in crude oil prices and demand for

organic agricultural products directly impact Essar’s export strategies,

requiring adaptive measures.

Graphical

Additions

- Trade Growth Timeline: A decade-long line graph showing export growth

segmented by product categories and geographical regions.

- Regional Heatmap:

Highlighting export intensity across continents, focusing on Essar’s

penetration in Asia, Europe, and the Americas.

Challenges

and Mitigation Strategies

- Currency Fluctuations: To counter exchange rate volatility, Essar employs

financial hedging techniques.

- Regulatory Barriers:

The group’s proactive compliance measures and regular training for its

teams ensure smooth operations in various jurisdictions.

- Environmental Regulations: Essar’s investments in green technologies mitigate

risks related to stricter environmental laws.

Recommendations

Strategic

Expansion Beyond Current Markets

Essar Group can explore regions with

untapped potential, such as:

- Africa:

Leveraging its energy expertise to address the continent's growing demand

for refined petroleum products.

- Latin America:

Exporting agricultural products like nuts and vegetables, which align with

increasing health-conscious consumer trends.

Digital Transformation in Exports

- AI and Big Data:

Essar could enhance export operations using AI-powered predictive

analytics for demand forecasting and optimizing supply chain logistics.

- Blockchain for Transparency: Implementing blockchain technology in export

documentation can increase trust among international buyers and reduce

procedural delays.

Corporate

Social Responsibility (CSR) in Export Operations

Essar’s contributions to sustainable

practices in its export processes can be emphasized:

- Eco-Friendly Packaging: Adopting biodegradable or recyclable materials for

export goods.

- Carbon-Neutral Logistics: Partnering with shipping companies focused on reducing

carbon emissions.

Historical

Contributions to India’s Economy

Highlight Essar’s significant

milestones in export and their impact on India’s GDP growth:

- Energy Independence:

Exporting refined products to reduce trade imbalances.

- Employment Generation: Large-scale projects like refineries and steel plants

creating thousands of jobs.

Strategic

Collaboration

Essar could further benefit from

collaboration with:

- Global Logistics Providers: To expand its reach with improved efficiency in

delivery schedules.

- Technology Partners:

To integrate advanced tools for managing large-scale operations.

Innovation

in Product Development

- Customized Products:

Tailoring products to meet the unique needs of specific markets, such as

energy-efficient fuels or region-specific agricultural produce.

- Value Addition:

Expanding its offerings by processing raw materials into high-value goods

(e.g., organic fruits into juices or concentrates).

Discussion

Questions

- Export Trends Analysis: How can Essar leverage its strong presence in Canada

and New Zealand to tap into adjacent markets?

- Market Opportunity:

What strategies should Essar adopt to expand its green energy exports?

- Decision-Making Models: How can Essar’s emphasis on quality and compliance

strengthen its non-compensatory value proposition?

- Resilience Strategies: What lessons from Essar’s historical challenges can

guide its future expansions?

- Sustainability Focus:

How can Essar leverage green technologies to expand its market share in

environmentally conscious economies?

- Technological Adaptations: What role can AI and blockchain play in strengthening

Essar’s logistics and compliance systems?

- Economic Diversification: In light of changing global trade patterns, how should

Essar diversify its product offerings?

Teaching

Notes

- Learning Objective 1:

Understand the role of diversified export strategies in building a global

business.

- Learning Objective 2:

Analyze market opportunities for expanding operations in emerging

economies.

- Learning Objective 3:

Apply non-compensatory decision-making models to real-world corporate

scenarios.

- Learning Objective 4:

Discuss resilience in overcoming operational and financial challenges.

References

- Global Export Database: Essar’s export performance and

shipment details.

- Industry Reports: Trends in the energy and agricultural

export sectors.

- Company Financial Statements: Analysis of Essar’s

revenue from exports.

- Trade Regulations: Compliance requirements and their

impact on export operations.

- Economic Times Archives: Analysis of Essar’s financial contributions to India’s

export revenue.

- World Trade Organization (WTO): Guidelines impacting Essar’s compliance in global trade.

- International Energy Agency (IEA): Trends influencing energy product exports

Comments

Post a Comment