Strategic

Product Management with the HDTE Model: A Modern Twist on the BCG Matrix

Abstract:

The HDTE Model refines strategic

product management by categorizing products into four quadrants: Horse, Dog,

Tiger, and Elephant, inspired by the traditional BCG Matrix. This model uses

adjusted formulas for relative market share and market growth rate to provide a

nuanced view of market dynamics, guiding businesses in developing strategies

for investment, marketing, divestment, and profit maximization.

Comparative analysis between the BCG

Matrix and HDTE Model highlights potential benefits but also identifies areas

for further research. Future studies could include empirical validation across

industries, longitudinal assessments of long-term impacts, and sector-specific

case studies in fields like technology and healthcare. Quantitative analysis of

financial outcomes, strategic flexibility, integration with modern

technologies, and cross-cultural applicability are also key areas for

exploration. Addressing these areas will enhance understanding of the HDTE

Model's advantages, guiding businesses in selecting the most effective

strategic framework.

KEY WORDS – strategic product

management, HDTE, Twist ,BCG matrix

Introduction:

In the ever-evolving business

landscape, understanding a product's market position is crucial for strategic

decision-making. Since its introduction in 1970, the Boston Consulting Group

(BCG) Matrix has been a cornerstone for categorizing products based on market

growth rate and relative market share. However, as market dynamics become more

complex, a more nuanced approach is necessary to capture additional competitive

factors. The HDTE Model—Horse, Dog, Tiger, and Elephant—emerges as a refined

framework to address this need, enhancing the traditional BCG metrics with

adjusted formulas for relative market share and market growth rate.

The HDTE Model categorizes products

into four distinct quadrants: Horse (high growth, low share), Dog (high growth,

high share), Tiger (low growth, low share), and Elephant (low growth, high

share). This model introduces an adjusted relative market share formula that

considers the market shares of both the leading and challenger competitors,

along with a fraction of the company's own market share. Additionally, it

proposes a revised market growth rate formula, normalizing growth over a 60-day

period to provide a daily growth rate.

By incorporating these adjustments,

the HDTE Model offers a more comprehensive view of a product’s competitive

position, allowing businesses to devise more targeted strategies. This paper

explores the strategic applications of the HDTE Model, demonstrating how it can

guide investment, marketing, divestment, and profit maximization decisions. By

aligning product characteristics with specific strategic actions, the HDTE

Model ensures effective management and optimization of overall business performance;

representing a valuable evolution of the traditional BCG Matrix tailored to

today's complex market environment.

The comparative analysis of the BCG

Matrix and the HDTE Model lays the groundwork for understanding the differences

and potential benefits of the HDTE Model. However, this initial analysis

highlights several opportunities for further research to expand our

understanding and validation of the HDTE Model's effectiveness. Future research

could include empirical validation through studies across various industries to

compare the performance of the HDTE Model with the traditional BCG Matrix in

real-world settings. Longitudinal studies could assess the long-term impact of

adopting the HDTE Model on business performance and market positioning.

Additionally, sector-specific case

studies in technology, healthcare, and consumer goods can provide insights into

the model's applicability across different contexts. Quantitative analysis can

measure the financial outcomes and market success of companies using the HDTE Model

versus those using the BCG Matrix. Further research could also investigate the

strategic flexibility and adaptability of both models, their integration with

modern technologies, cross-cultural applications, customer perception and brand

impact, competitor analysis, and support for sustainability and innovation.

Addressing these areas can significantly enhance our understanding of the HDTE

Model's comparative advantages and limitations, ultimately guiding businesses

in selecting the most effective strategic framework for their needs.

Literature Review –

The foundational concept of the BCG

matrix, introduced by Henderson in "The Product Portfolio" (1970),

emphasizes the strategic categorization of business units and products to

optimize resource allocation. Wind and Mahajan (1981) discuss its strategic

applications in long-term planning in "Designing Product and Business

Portfolios," while Day (1977) critiques its simplicity in "Diagnosing

the Product Portfolio," advocating for supplementary tools. Empirical

applications and limitations are illustrated through case studies by Kotler and

Keller in "Marketing Management" (2016) and by Aaker in

"Strategic Market Management" (2008). Doyle (1998) in "Marketing

Management and Strategy" critiques the BCG matrix's static nature,

proposing alternative frameworks, while Mintzberg and Lampel (1999) in

"Reflecting on the Strategy Process" call for more dynamic

approaches. Grant (2016) in "Contemporary Strategy Analysis" explores

adaptations for the digital era, and Johnson, Scholes, and Whittington (2020)

in "Exploring Strategy: Text and Cases" examine its relevance in

modern strategic management.

Haradhan Kumar Mohajan (2018)

analyzes how the BCG matrix can help identify which strategic business units to

invest in, sell, or shut down, aiding companies in efficient resource

distribution and management. The paper serves as a guideline for businesses to

adopt optimal strategies using the BCG matrix. Chih-Chung Chiu and Kuo-Sui Lin

(2019) critique the traditional BCG matrix as a static tool that fails to

consider different time frames. Their study proposes a dynamic BCG method

incorporating trend analysis and varying time frames for product portfolio

evaluation. A numerical case study demonstrates the effectiveness of this new

method in assessing company products' market positions and formulating resource

allocation strategies. The rule-based BCG method introduces a new data

collection approach using a vague set and provides a novel application for

strategic market positioning and resource strategy development.

Analyses and

discussion

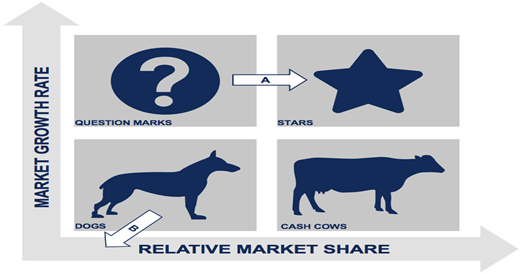

The BCG Matrix uses the horizontal

axis to represent a product's market share and competitive strength, measured

through relative market share. The vertical axis shows the product's market growth

rate and potential. The matrix includes four quadrants: Question Marks (high

growth, low share), Stars (high growth, high share), Dogs (low growth, low

share), and Cash Cows (low growth, high share). It assumes that higher relative

market share leads to increased cash flow due to economies of scale and cost

advantages. Typically, a 10% market growth rate is the threshold between high

and low growth.

The formula for calculating relative

market share is:

Relative Market Share=Company’s Market Share/Largest Competitor’s Market Share

This ratio compares a company's

market share to that of its largest competitor in the same industry, providing

insight into the company's competitive position.

To be modified as

Adjusted Relative Market Share=(Leader Competitor’s Market Share+Challenger Competitor’s Market Share

Company’s Market Share/4 )×100

In this formula:

- Company’s Market Share: The market share of the company being analyzed.

- Leader Competitor’s Market Share: The market share of the leading competitor.

- Challenger Competitor’s Market Share: The market share of the challenger competitor.

- Company’s Market Share/4: One-quarter of the company's market share added to

the denominator.

This formula provides an adjusted

relative market share that considers both the leader and the challenger

competitor's market shares, along with a fraction of the company's own market

share

The formula for calculating market

growth rate is:

Market Growth Rate=Current Market Size−Previous Market Size/Previous Market Size×100

In this formula:

- Current Market Size:

The total market size at the end of the period.

- Previous Market Size:

The total market size at the beginning of the period.

This formula provides a percentage

that represents the rate of change in the market size over time. It's essential

for companies to understand the market growth rate to make informed decisions

about investment, product development, and market positioning.

By modified above formula

Calculate

the growth rate using the leader's market size, challenger's market size, and X

Company’s market size over a period of 60 days;

Growth Rate=(Leader Market Size−Challenger Market Size/ Company Market Size×100/60

This formula represents the growth

rate per day, as it normalizes the growth over the 60-day period. Let's break

it down step by step:

- Difference in Market Size:

Leader Market Size−Challenger Market Size

gives the difference between the market sizes of the leader and the challenger.

- Normalized by X Company Market Size:

Dividing the difference by X Company Market Size

normalizes this difference with respect to X company's market size.

- Conversion to Percentage:

- Multiplying by 100 converts this value to a

percentage.

- Normalization over 60 days:

- Dividing by 60 days provides a daily growth rate.

Thus, this formula provides a

percentage growth rate normalized to a daily rate over a 60-day period.

|

|

|

|

Market

Growth Rate

|

|

|

|

Adjusted Relative Market Share

The matrix plots a company’s offerings in a four-square

matrix, with the y-axis representing the rate of market growth and the x-axis

representing market share. It was introduced by the Boston Consulting Group in

1970. But this model was modified with some microscopic changes for present scenario

HDTE

MODEL PRODUCT PORTFOLIO ANALYSIS

.

- Horse:

Products with high market growth but a low market share.

- Dog:

Products with high market growth and a high market share.

- Tiger:

Products with low market growth and a low market share.

- Elephants:

Products with low market growth but a high market share.

Let's elaborate on each of these

categories:

1.

Horse: Products with High Market Growth but Low Market Share

Characteristics of a Horse:

- Agile and fast, but needs direction and nurturing to

become a champion.(product penetration )

Business Strategy:

- Investment:

Like training a young horse, these products need significant investment to

improve their capabilities and increase market share.

- Marketing:

Promote the product vigorously to build brand awareness and capture a

larger market segment.

- Innovation:

Continue to innovate and improve the product to gain a competitive edge in

the growing market.

Example:

- A new tech gadget in a rapidly expanding market with

many competitors.

2.

Dog: Products with High Market Growth and High Market Share

Characteristics of a Dog:

- Loyal, strong, and a leader in its territory.(market

penetration)

Business Strategy:

- Sustainability:

Maintain the product's dominant position through ongoing investment in

marketing and innovation, much like keeping a dog healthy and active.

- Expansion:

Explore new markets or diversify offerings to capitalize on growth

opportunities.

- Efficiency:

Improve operational efficiencies to maximize profit margins and ensure the

product continues to lead in the market.

Example:

- A leading smartphone brand that dominates a growing

market.

3.

Tiger: Products with Low Market Growth and Low Market Share

Characteristics of a Tiger:

- Fierce but isolated, struggles to thrive in a declining

environment.( liquidation /Divestiture)

Business Strategy:

- Divestment:

Consider discontinuing the product to allocate resources more effectively,

similar to a tiger being moved to a more suitable habitat.

- Niche Focus:

Identify and target niche markets where the product might perform better.

- Cost Management:

Minimize costs to reduce losses, ensuring the product doesn't drain

resources.

Example:

- An outdated technology product in a market that's being

overtaken by newer innovations.

4.

Elephant: Products with Low Market Growth but High Market Share

Characteristics of an Elephant:

- Large, stable, and strong, commanding respect in its

environment.( concentric Diversification)

Business Strategy:

- Profit Maximization:

Focus on maintaining efficiency and maximizing profits, like ensuring an

elephant is well-cared-for to keep it strong.

- Cost Control:

Keep operational costs low to maintain high profitability.

- Harvesting:

Use the steady revenue generated by these products to fund other growth

opportunities within the business.

Example:

- A well-established household product that enjoys a

loyal customer base in a stable market.

By aligning product categories with

these animal characteristics, businesses can develop targeted strategies that

leverage the inherent strengths and weaknesses of each product type, ensuring

they are managed effectively to maximize overall business performance.

Limitation of HDTE model – The

HDTE Model's complexity, data demands, and reliance on static assumptions limit

its effectiveness across diverse, dynamic market conditions.

.

Conclusion: The HDTE Model offers a contemporary framework for

strategic product management by refining the categorization of products based

on market dynamics. By incorporating adjusted metrics for relative market share

and market growth rate, this model provides a more comprehensive view of a

product's competitive position. The animal characteristics—Horse, Dog, Tiger,

and Elephant—serve as intuitive metaphors for understanding the strategic needs

of each product category. Through targeted strategies, such as investment,

marketing, divestment, and profit maximization, businesses can effectively

manage their product portfolios to enhance overall performance. The HDTE Model

thus represents a valuable evolution of the traditional BCG Matrix, better

suited to the complexities of today's market environment. Comparative

Analysis of BCG Matrix and HDTE Model

References

References

- Aaker, D. A. (2008). Strategic Market Management.

John Wiley & Sons.

- Chiu, C.-C., & Lin, K.-S. (2019). Rule-Based BCG

Matrix for Product Portfolio Analysis. In Studies in Computational

Intelligence (Vol. 850).

- Day, G. S. (1977). Diagnosing the Product Portfolio. Journal

of Marketing.

- Doyle, P. (1998). Marketing Management and Strategy.

Prentice Hall.

- Grant, R. M. (2016). Contemporary Strategy Analysis.

Wiley.

- Henderson, B. D. (1970). The Product Portfolio. BCG

Perspectives.

- Johnson, G., Scholes, K., & Whittington, R. (2020).

Exploring Strategy: Text and Cases. Pearson.

- Kotler, P., & Keller, K. L. (2016). Marketing

Management. Pearson.

- Mintzberg, H., & Lampel, J. (1999). Reflecting on

the Strategy Process. Sloan Management Review.

- Mohajan, H. K. (2018). An Analysis on BCG Growth

Sharing Matrix. Noble International Journal of Business and Management,

2(1), 1-6.

- Wind, Y., & Mahajan, V. (1981). Designing Product

and Business Portfolios. Harvard Business Review.

No comments:

Post a Comment